Moscow-City, the capital's main business cluster, is experiencing unprecedented office price growth. Over the past 12 months , office rents here have increased more than 50 percent . The average rental rate in Moscow-City's prestigious towers has exceeded 80,000 rubles per square meter per year, reaching a historic high. By comparison, average Class A office rental rates in Moscow have increased by approximately 39% year-on-year. Thus, the Presnenskaya Embankment business center is significantly outperforming the rest of the market in terms of price dynamics. The most premium properties are showing particularly strong growth: elite Prime-class offices in modern skyscrapers have doubled in price compared to last year.

The rapid rise in rental costs is explained by a combination of factors:

-

Firstly , the shortage of vacant space in Moscow City has reached critical levels. By the end of the first half of 2025, the vacancy rate in the complex's towers had dropped to 1.2% , while just ten years ago, the vacancy rate was 14 times higher . Vacant units in this "city within a city" are disappearing from the market in a matter of days, as demand for prestigious offices remains high.

-

Secondly , strong demand from large Russian companies is supporting rising rents. Despite the departure of Western tenants in 2022, the space they vacated has quickly been occupied by domestic companies , many of which are expanding and willing to pay a premium for location and quality.

-

Thirdly , Moscow City's prestige and status as a headquarters location has only strengthened. Modern infrastructure, proximity to the city center, and concentrated business space make this location extremely attractive for businesses, particularly those in the financial, technology, and government sectors.

It's important to note that rent growth in Moscow City is outpacing even other popular business districts in Moscow. For example, in the Paveletsky business cluster, rents have increased by approximately 50% over the year, while in the Belorussky district, they've only increased by 6-7% . This difference is due not so much to lower interest in other locations, but to the limited quality supply in them: the best properties there are already occupied, and new projects are few and far between. Thus, Moscow City acts as a kind of "overheated" zone, where the concentration of demand and premium properties drives prices up most significantly.

Demand is shifting to the Big City

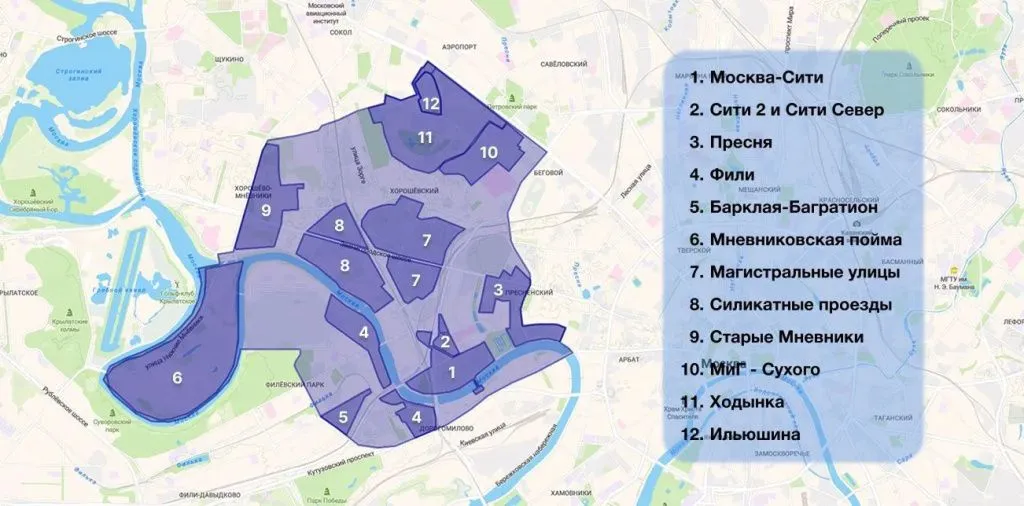

Amid record prices in Moscow City, the surrounding area, known as "Big City," is attracting increasing attention. Big City is a large-scale development project for industrial zones and new neighborhoods adjacent to Moscow City, designed to expand the boundaries of the capital's business center. This macro-location covers approximately 3,200 hectares (more than 50 times the size of Moscow City itself) and encompasses parts of several Moscow districts – from Presnensky in the center to Khoroshevo-Mnevniki and Filevsky Park in the west. Within Big City are several dozen metro stations, the Moscow Central Circle (MCC), and the Moscow Central Diameters (MCD), providing excellent transport accessibility. All this creates the preconditions for the formation of a new major business core.

Over the past three years, demand for offices in the Moscow City area has demonstrated impressive growth. Following a decline in business activity in 2022, the volume of transactions in Moscow City locations (office leases and sales) increased by 219% in 2023, exceeding 360,000 square meters annually. In 2024, this growth continued by almost a third. Moreover, approximately 75% of the total transaction volume occurred in several areas closest to Moscow City, primarily Khoroshevo and Khodynka. These areas, practically adjacent to the skyscraper complex, have become the main beneficiaries of unmet demand: companies experiencing cramped or expensive space within Moscow City are seeking alternatives just a few kilometers away.

High demand has already impacted prices and vacancy rates in the Big City district. Average rental rates in business centers in this area have risen from approximately 32,000–33,000 rubles per square meter per year (in 2022) to 45,000–47,000 rubles in 2025. A number of new high-end complexes—for example, the JOIS and iCITY projects—are setting modern quality standards here, with rental rates approaching those in central districts. Meanwhile, vacancy rates in modern Class A properties on Khodynka and Khoroshevskoye Shosse are currently minimal: experts note that less than 0.5% of the space is vacant, meaning virtually all the space is occupied. Thus, the Big City district has already established itself as one of the most attractive locations for business, and projects with developed infrastructure and proximity to the metro are particularly in demand. According to consultants, rents in office complexes located within a 5-10-minute walk of a metro station are 15-20% higher than in projects further away. This encourages developers to prioritize transport accessibility when developing new areas in the Big City.

Supply shortages and postponements

Despite reduced developer activity, demand continues to break records. In the first quarter of 2025 alone, over 300,000 square meters of office space were sold in Moscow (including leases and purchases), a record quarterly figure for the past decade. In the first half of 2025, Class A office space sales totaled approximately 82,000 square meters , 9% higher than the first half of 2024. This high absorption rate, coupled with the decline in new construction, has led to a near-zero supply of available office space, intensifying competition for vacant space.

One of the main reasons for the overheating of the Moscow office market is the significant lag between new supply and demand . Not a single new Class A business center was commissioned in the capital in the first half of 2025. Many announced projects are being postponed: consultants note a trend of widespread office building delivery delays. According to updated forecasts, only about 500,000–600,000 square meters of new office space will actually be delivered by the end of 2025, which is approximately half of the originally planned volume. Moreover, up to half of this volume will be build-to-suit projects, built for specific clients that will not enter the open rental market. Thus, the shortage of ready-to-use office space is only worsening.

Low commissioning rates are leading to rapid absorption of existing vacant space. The overall share of office vacancies in Moscow fell to 4-5% by mid-2025, close to a historical low. In Class A, the vacancy rate is even lower – approximately 5.6-5.7% (1-2 percentage points lower than a year ago). In established business clusters (Moscow City, the city center, and the Belorussko-Leningradsky District), the supply of large office blocks for sale or rent is virtually nonexistent, leading to accelerated rental growth in these areas. For example, according to consulting firms, average rental rates at the beginning of summer 2025 in Moscow City were approximately 72,000 rubles per square meter per year (including VAT), in the traditional Central Business District – approximately 65,000 rubles , and in the Leningradsky Prospekt area – approximately 57-58,000 rubles . Accordingly, it is in these locations that the largest lease deals are concluded. A prime example: Magnit recently leased an entire building (Tower A of the STONE Towers complex near the Belorusskaya metro station), with an area of approximately 11,000 square meters, for its own office.

The shortage of large office space in a single block is particularly acute. According to market participants, there are currently literally a dozen vacant office blocks of 7,000 square meters or more within the Third Ring Road. This is critically low, considering that over 200 companies are currently seeking space over 10,000 square meters each. There are also limitations for medium and small-sized offices: office blocks of 200–800 square meters are the most in demand, and these also fill up quickly. As of mid-2025, the average rental rate for a small block of up to 500 square meters within the Moscow Ring Road reached approximately 61,000 rubles/sq. m per year (including VAT), reflecting tenants' willingness to pay a premium for high-quality offices, even those of a smaller size.

In this situation, companies planning expansion are often forced to postpone relocation. Large businesses are already looking at projects scheduled for completion in 2027–2028, as it's currently impossible to find 7,000–10,000 square meters of modern office space. Experts note that almost three-quarters of the space currently under construction and scheduled for delivery in 2025–2026 has already been either purchased or leased under preliminary agreements. In projects scheduled to enter the market by the end of 2026, no more than 25–30% of the total space is available for sale or lease—the rest is already booked. Therefore, the shortage will persist for the next two to three years , and the vacancy rate in Moscow is projected to fall below 4% by the end of 2025.

New trends: from renting to buying and decentralization

Faced with a shortage of quality offices and steadily rising rental rates, companies are beginning to change their approach to securing office space. One notable trend is the growing interest in purchasing office blocks or buildings instead of long-term leases. While Western corporations previously viewed office acquisition as a non-core activity (they preferred leasing), Russian firms, on the contrary, are now actively acquiring real estate for their own needs. Purchasing a large office has become a hedging tool against further rent increases. Several high-profile transactions took place in the first half of 2025: for example, the EFKO Group acquired the Arcus IV business center (~25,000 sq. m) for its new headquarters, and Transcapitalbank (T-Bank) purchased the Central Telegraph building (~28,000 sq. m) in central Moscow for its own offices. At the same time, long-term tenants among large corporations are increasingly demanding a buyout option to gain control of critical business assets.

The second important shift is the gradual shift of business activity beyond the historic center and the development of new office hubs. Since there are virtually no sites left within the Garden Ring for large new office developments (the center currently accounts for less than 2% of all office space under construction), developers are concentrating on other locations. The outskirts of the Central District and adjacent areas, where available land for integrated development is available, have become the main "points of attraction." In addition to the aforementioned Big City, experts highlight such promising business districts as Khodynka , Mnevniki , the cluster around the Belorusskaya-Savelovskaya metro stations, and the southwestern zone near the Kaluzhskaya metro station . The majority of Class A office complex projects are currently concentrated there. It is estimated that up to 70% of all office space under construction in Moscow is located outside the Third Ring Road. Moreover, the majority of new business centers are part of mixed-use projects combining offices, residential units, and retail infrastructure. This format meets modern tenant demands—companies want to provide employees with the opportunity to work, live, and relax in a comfortable environment without long commutes. The "live, work, and relax in one area" concept is gaining popularity and is being implemented in many areas of the Big City and other new clusters beyond the Third Transport Ring.

Developers, seeing steady demand, are also adapting to the new reality. Some major commercial real estate players (for example, STONE, which emerged from the residential sector) are focusing on fragmented office sales by floors and blocks, offering businesses more flexible acquisition options. Constructing a single building for a single tenant is expensive and risky under current conditions, but selling small lots allows for a faster return on investment and attracts more investors. As a result, more small office owners and private investors are entering the market, while large, single-lot properties remain in short supply. It's likely that fully leased towers will be launched rarely in the coming years. Instead, new projects are focusing on a mixed model, where a significant portion of the space is purchased outright by end users. Examples include the construction of a 75-story Wildberries&Russ business center , or negotiations to purchase a significant portion of the office space in the new CITY-4 office complex or the Moscow Exchange (MOEX) Empire II.

Outlook: Continued high activity and new projects

Analysts agree that current trends in the Moscow office market will persist in the near future. A shortage of quality space, coupled with robust demand from large businesses, means rental rates will continue to rise. While the pace of this growth is likely to slow somewhat compared to the record-breaking 2024–2025, office rental rates in top locations (including Moscow City) could increase by another 10–15% during 2026. Many companies are already budgeting for increased real estate costs or are trying to lock in lease terms for several years ahead, fearing further price increases. At the same time, the continued low vacancy rate—the vacancy rate is expected to fall below 4% by the end of 2025—will support investor interest in office real estate as an asset.

In the longer term, the solution to the space shortage should come with the implementation of major projects in Moscow's Greater City and other new business districts. Moscow authorities plan to build up to 5 million square meters of real estate in Moscow's Greater City by 2035 , a significant portion of which will be office and public/business facilities. New skyscrapers and business parks, offering tens of thousands of square meters of office space, are already under construction and scheduled for completion in the coming years. For example, the 379-meter supertall One Tower is under construction in Moscow City itself, offering over 40,000 square meters of premium office space in addition to apartments. In the Khodynka Field area, the first phase of the STONE Khodynka office cluster is nearing completion. It includes several Class A towers with large vacant units for lease and sale. Such projects are intended to partially satisfy pent-up demand from corporations seeking modern, spacious offices.

Nevertheless, experts warn that completely eliminating the shortage of large offices in Moscow will be difficult in the short term. Demand from large companies for space over 10,000 square meters remains significantly higher than the market supply. It's likely that large office lots (entire buildings or floors) will continue to be auctioned off during the construction phase. Consultants expect the limited supply to keep the market moderately overheated, especially in the premium segment. For tenants, this means the need to make decisions more quickly and be flexible in choosing a location or office format. Some will consider relocating to new business districts outside the center, others will reduce their space requirements and optimize their layouts, and still others will invest in their own office to secure a location in the desired area.

According to NF Group, by the end of the first half of 2025, the vacancy rate in Moscow City had fallen to a record low of just 1% , signaling a critical supply shortage in this cluster. In July, the average rental rate exceeded 80,000 rubles per square meter per year, an increase of 50% year-on-year. At the same time, the volume of space listed for sale in Moscow increased by 60% , which may indicate that some owners are choosing to liquidate their assets more quickly than invest further.

Conclusion: Moscow City is currently experiencing a veritable office boom, becoming a symbol of the capital's post-pandemic economic recovery. Record rental rates and minimal vacancy rates confirm this location's status as a key destination for the business elite. At the same time, an expanded Greater City is emerging around the skyscrapers – a new pole of business activity where the development of modern office space is concentrated. In the coming years, the balance between the ultra-expensive, high-status Moscow City and the more affordable, yet rapidly growing Greater City will determine the shape of Moscow's office market. Companies are gaining more location options – from prestigious towers to innovative clusters in former industrial zones – but competition for the best offices remains fierce. The capital's commercial real estate market is entering a new phase, where flexibility and strategic planning are becoming the keys to success for all participants.

Advertising on the portal

Advertising on the portal