Ex-Money - crypto exchange service

Cryptocurrency exchanges in Russia Ex-Money -

today is a day off

-

Monday- - -

-

Tuesday- - -

-

Wednesday- - -

-

Thursday- - -

-

Friday- - -

-

Saturday- - -

-

Sunday- - -

Are you the owner?

- m.«Moscow-City» 4 min. walk

- m.«Business Center» 6 min. walk

Ex-Money

Ex-Money is built around a simple idea: modern technology should save time and reduce unnecessary costs. When exchanging becomes a routine task, what matters is not marketing wording but processing speed, route stability, and clear terms before payment. That is why the ex-money service positions itself as an innovative exchange platform with a focus on automation and high-quality operational support.

The Ex-Money crypto exchanger suits different scenarios: fast coin-to-coin swaps, buying or selling cryptocurrency, and withdrawals into e-money systems and fiat routes. A key part of the concept is a wide conversion matrix: the service claims more than 5,000 exchange directions, allowing users to build a route for a specific task without manually “looking for workarounds” via third-party platforms.

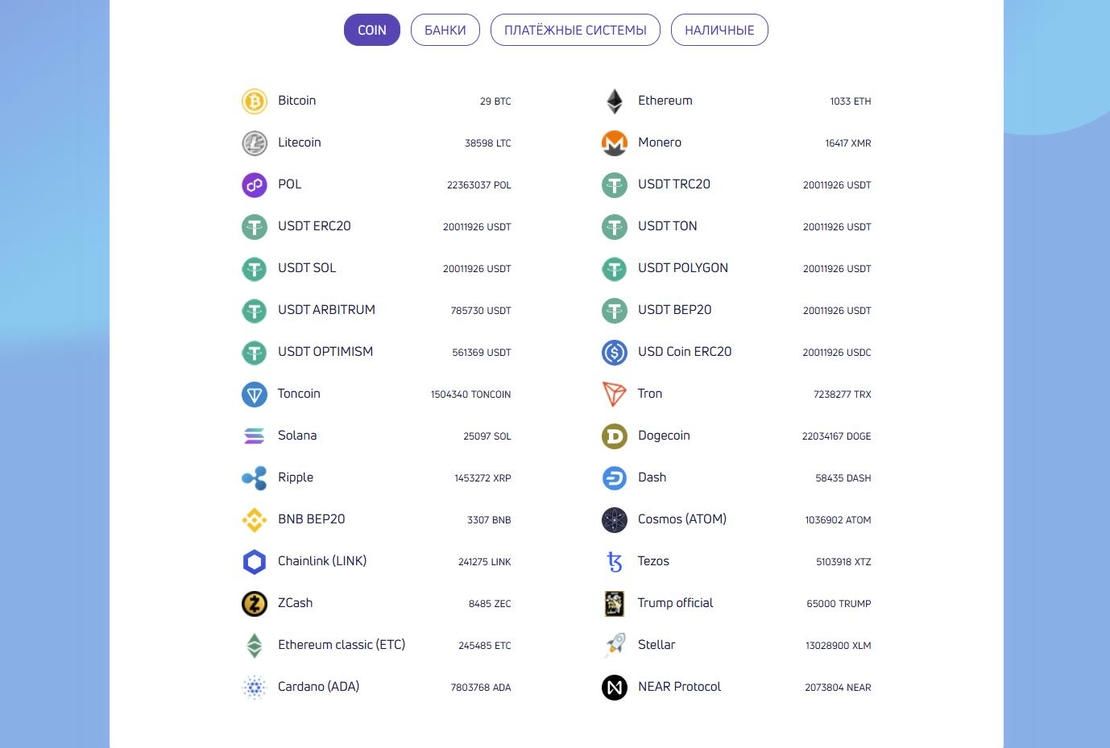

Directions and supported assets

The foundation is made up of the most in-demand coins that the market uses most often: core cryptocurrencies and networks, as well as e-money systems for deposits and withdrawals. At the same time, the directions list can be broader than the “showcase” assets: some pairs may appear or disappear depending on liquidity, reserves, and current channel conditions.

- Cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Stellar (XLM).

- Popular networks and coins: Dash, Ripple (XRP), Tron (TRX), Monero (XMR).

- E-money systems and partner channels: Volet, Utopia.

Reserves matter for larger operations. Ex-Money emphasizes that its reserve volumes support not only individual orders but also wholesale clients, where both amount and execution speed are critical.

Rates, service quality, and the development approach

The exchange market is dynamic, and services that do not evolve quickly lose quality. Ex-Money states this directly in its positioning: the platform aims to keep rates competitive and continuously improve service. In practice, this means regularly updating directions, supporting relevant deposit and withdrawal channels, and working with reserves so exchanges do not “hit” amount limitations.

- Competitive terms on popular directions.

- A wide conversion matrix, with more than 5,000 directions claimed.

- Reserves and routes for operations of different scales.

Deal transparency and work with monitoring platforms

Another part of the infrastructure is cooperation with major monitoring platforms. The goal is to keep the service’s terms and reputation metrics verifiable in an independent environment. Such systems typically show review dynamics, presence history, core operating parameters, and overall platform stability, helping users assess deal transparency before placing an order.

KYC/AML: risk control and transaction security

The service includes KYC/AML procedures. AML checks are used to assess crypto transactions and addresses using risk indicators, while KYC may be requested when required by the rules of a specific direction, by limits, or by internal risk-management policy. If a transaction receives an elevated risk score or there are questions about the source of funds, the exchange may be paused until details are clarified, supporting documents are provided, or verification is completed. This approach helps filter suspicious flows and protects legitimate exchanges.

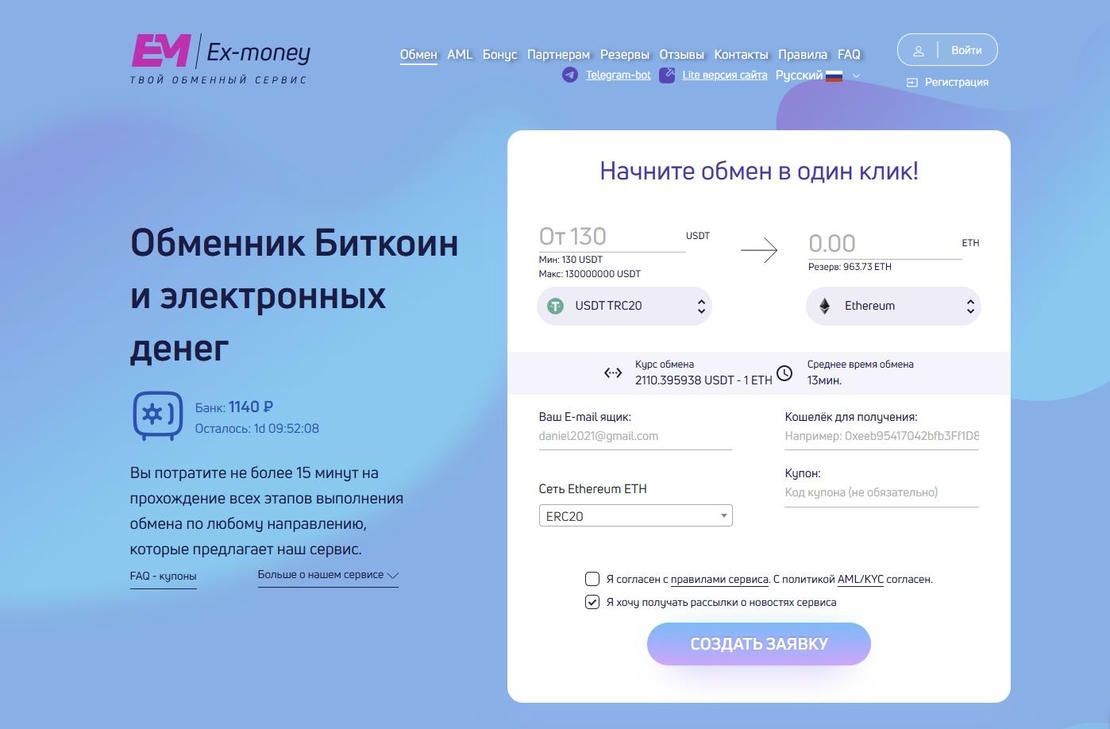

How the exchange works

The order flow is designed so the user sees the terms in advance. You choose a direction, enter the details, and confirm payment. After funds are received, the order is executed and the status is updated step by step. On crypto directions, speed depends on the selected network and the number of confirmations, so it is important to specify the correct network, address, and any additional fields if required.

- Terms before payment: rate, limits, and the final amount calculation.

- Verification of details and network to avoid sending errors.

- Step-by-step order status until completion.

Ex-Money is an exchange service that focuses on technology, a broad directions matrix, and predictable execution. It supports popular coins and e-money systems, claims large reserves, and cooperates with monitoring platforms to improve transparency. Ex-Money covers both fast conversions and larger operations, while KYC/AML procedures add a controlled layer of security to exchange scenarios.

Ask a question to a company representativeLeave your comment or question

Leave your comment or question

Thank you for your comment

It will be checked by the moderator and posted on the site soon

Оставьте заявку

Мы подберем лучшие объекты из базы.

Leave a request

We will select the best objects from the database.

Thank you for your request

Our managers will contact you soon

Leave a request

We will select the best objects from the database.

Thank you for your request

Our managers will contact you soon

Запрос на редактирование

Оставьте запрос на редактирование раздела

Получить доступ

Оставьте запрос на редактирование объекта

Спасибо за обращение

Our managers will contact you shortly

Сообщить об ошибке

Оставьте запрос на исправление ошибки

Advertising on the portal

Advertising on the portal