Receive-Money crypto exchanger

Crypto exchangers Receive-Money -

today is a day off

-

Monday- - -

-

Tuesday- - -

-

Wednesday- - -

-

Thursday- - -

-

Friday- - -

-

Saturday- - -

-

Sunday- - -

Are you the owner?

- m.«Moscow-City» 4 min. walk

- m.«Business Center» 6 min. walk

Receive-Money

Receive-Money is a cryptocurrency exchange service suitable for basic “crypto ↔ crypto” and “crypto ↔ fiat” operations. The main practical purpose of such platforms is to quickly convert popular assets, transfer funds between wallets, or withdraw part of the balance to bank details without using exchange terminals and complex trading interfaces.

The Receive-Money crypto exchanger can be convenient in situations where you need to complete a one-time transaction or regularly exchange stablecoins and major coins as part of everyday tasks: buying cryptocurrency, locking in profits, transferring funds between networks, or cashing out to fiat. At the same time, overall convenience always depends on the specific terms of the chosen direction — the rate, fees, limits, and available reserve.

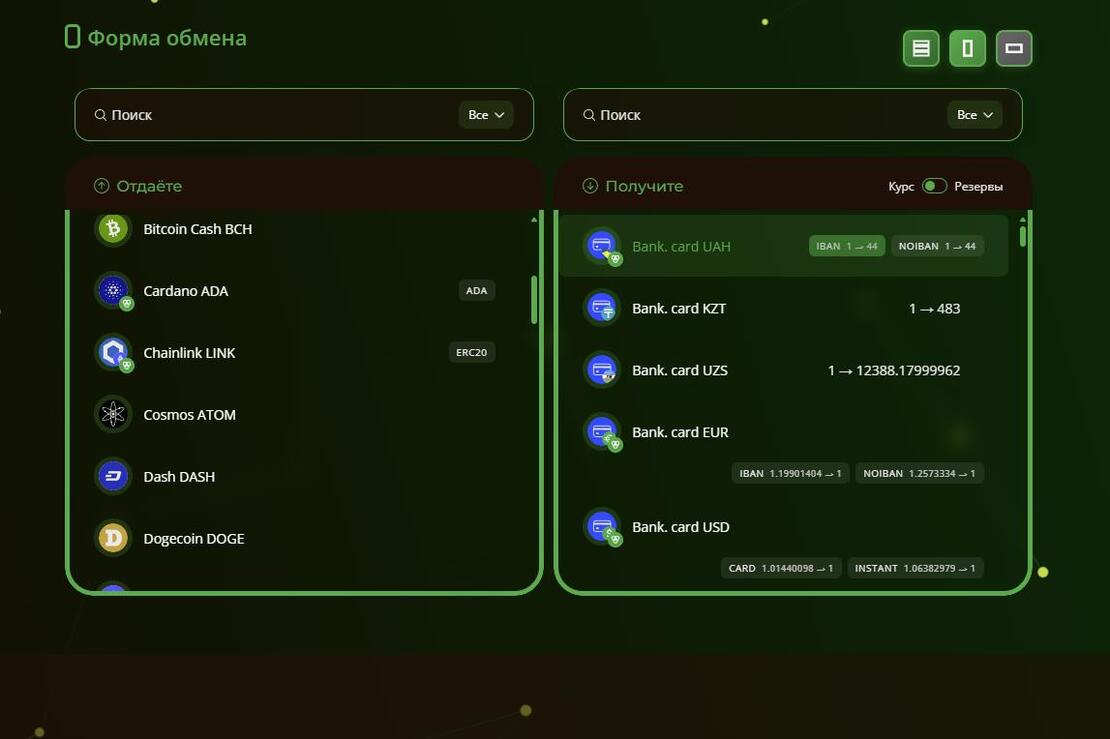

Exchange directions and supported assets

The exact list of currencies and pairs depends on the service’s current settings and available liquidity, however, in most cases exchangers of this type focus on the most in-demand assets. As a rule, major coins and popular stablecoins are available, and exchange directions are built around typical scenarios: crypto-to-crypto exchange, crypto withdrawals to a bank/card, and buying cryptocurrency via bank details.

If you need to exchange rare coins or non-standard networks, it is better to check the availability of the required direction in advance. In real practice, most exchangers keep their focus on liquid assets in order to ensure stable processing and sufficient reserves for key pairs.

USDT and network selection: TRC20, ERC20, BEP20

USDT remains one of the most widely used assets for exchanges and withdrawals. However, when working with it, network selection is important, since the same stablecoin can be issued and transferred through different blockchains: TRC20, ERC20, or BEP20. The chosen network affects the fee, confirmation speed, and the likelihood of transfer mistakes.

TRC20 is often chosen due to lower network fees and fast processing. ERC20 belongs to the Ethereum network and can be more expensive during high congestion. BEP20 is used within the BNB Chain ecosystem and is convenient for transfers inside it. In any case, the sending network must match the receiving network: a mismatch leads to delays and may require additional checks or manual investigation.

How an exchange works in Receive-Money

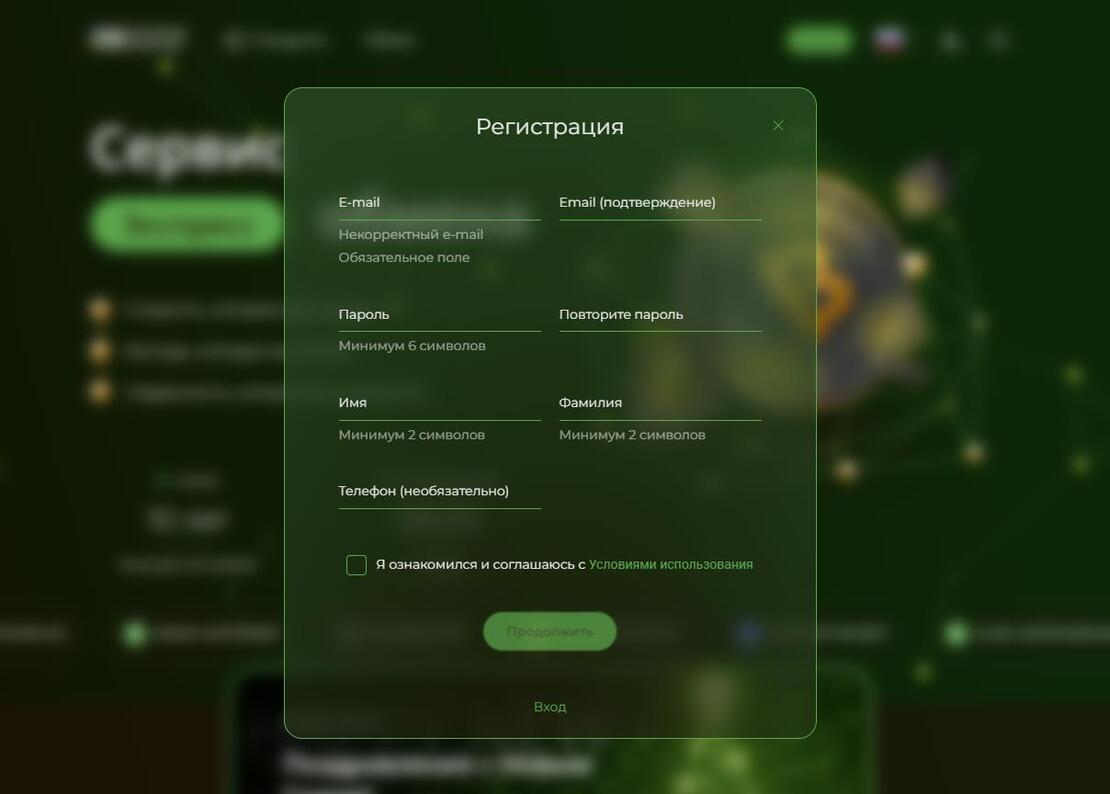

The exchange process is usually built around an order and includes sequential steps: selecting a direction, entering the amount, filling in the details, confirming the terms, and completing the transfer. After the funds are received, the service finishes processing and makes the payout to the specified details. Depending on the direction, the rate may be fixed for a certain period or calculated using a floating mechanism until the funds are actually received.

- Select the exchange direction and enter the amount, taking into account the minimum and maximum limits.

- Fill in the recipient details (wallet address or bank details) and confirm the rate terms for the order.

- Send the funds to the order payment details and wait for network confirmations and payout completion.

Before sending funds, it is recommended to double-check the network, the address/details, and the final amount to be received. If the direction requires a payment reference or additional recipient data, these fields should be filled in strictly according to the order terms, since mistakes in details most often lead to delays.

Rates, fees, limits, and reserves

To objectively evaluate the terms, it is important to focus on the final amount rather than the displayed rate without context. The result is influenced by the type of rate (fixed or floating), network fees, possible service fees, and amount restrictions. Blockchain fees do not depend on the exchanger and can differ significantly between networks, especially during periods of high congestion.

Additionally, it is recommended to consider the reserve availability for the chosen direction. If the reserve is limited, processing may take longer or require waiting. This is especially relevant for popular pairs and fiat operations, where payouts depend on available liquidity and current workload.

Processing speed and factors that affect timing

Exchange speed is formed by several independent factors. For cryptocurrency operations, the key factors are network congestion, the transaction fee size, and the number of confirmations. For fiat directions, bank regulations, time of day, and transfer processing specifics matter, including weekends.

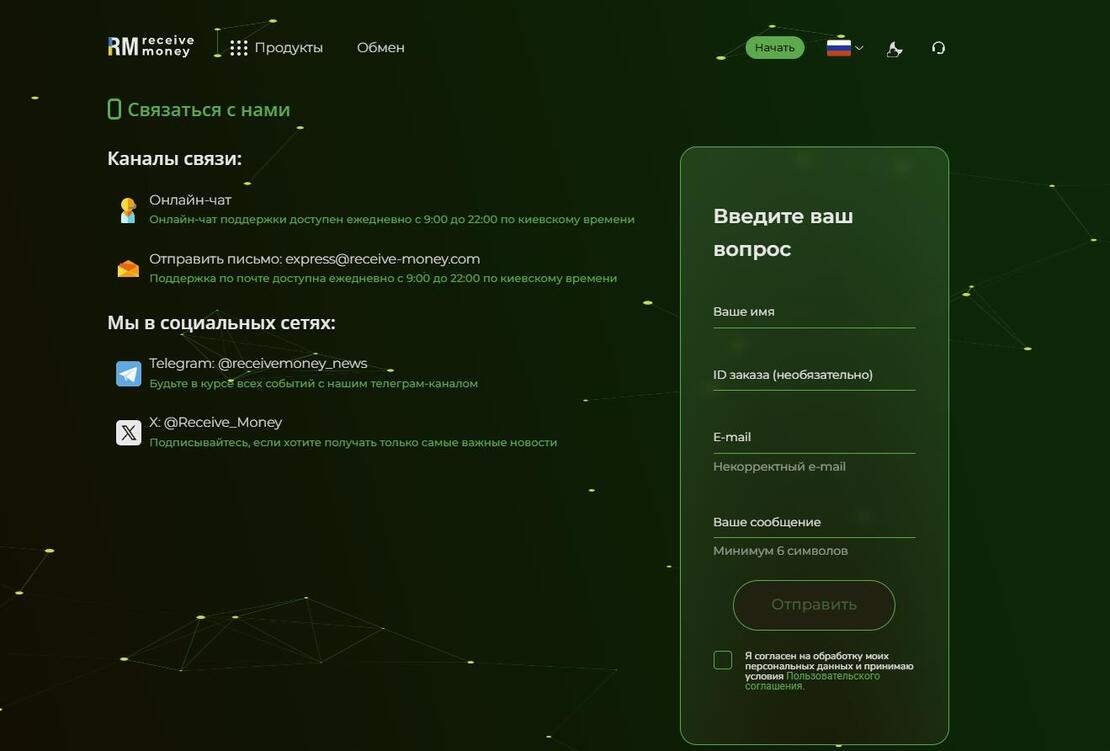

Delays do not always mean an error in the service’s operation. In some cases, funds have already been sent, but the transaction is waiting for confirmations, or the banking part is taking longer than standard processing time. In such situations, it is useful to rely on the order status and keep the transaction details until the exchange is completed.

Security when exchanging

When exchanging cryptocurrency, the main risks are most often related to phishing and mistakes in payment details. It is recommended to visit only the official service website, carefully check the domain, and avoid links from suspicious sources. Any payment details must be provided directly in the order; sending funds “outside the order” creates a risk of losing control over the transaction.

It is also important to keep transfer confirmations and order details until the operation is fully completed. This helps resolve disputed situations faster and clarify the status in case of unusual delays.

AML/KYC and additional checks

Modern exchangers apply AML checks (Anti-Money Laundering) to assess the origin of funds and identify high-risk transactions. Additional review may be required if funds are linked to fraudulent schemes, sanctioned addresses, mixer services, or other risk sources. For stablecoins, this topic is especially relevant, since they often pass through a large number of wallets.

If increased risk is detected, the service may request identity verification (KYC), transaction details, or proof of the source of funds. To reduce the likelihood of delays, it is recommended to avoid mixer services, not accept transfers from suspicious counterparties, and, whenever possible, use wallets with a clear incoming transaction history.

Basic recommendations that usually help reduce the likelihood of delays include:

- do not use mixers and services that hide the origin of funds

- do not accept transfers from unknown counterparties without verification

- avoid addresses and sources with a questionable reputation

- whenever possible, use wallets with a clear incoming transaction history

Conclusion

The Receive-Money crypto exchanger is suitable for standard exchange and cash-out operations, provided you carefully check the details, network, and order parameters. The final result depends not only on the rate, but also on network fees, limits, reserve availability for the chosen direction, blockchain confirmation speed and bank processing, as well as AML requirements. Before sending funds, it is recommended to once again verify the network, payment details, and rate terms in order to minimize the risk of mistakes and delays.

Ask a question to a company representativeBeen here?

Leave your review of your visit.

Thank you for your review

It will appear on the site soon after moderation

Оставьте заявку

Мы подберем лучшие объекты из базы.

Leave a request

We will select the best objects from the database.

Thank you for your request

Our managers will contact you soon

Leave a request

We will select the best objects from the database.

Thank you for your request

Our managers will contact you soon

Запрос на редактирование

Оставьте запрос на редактирование раздела

Получить доступ

Оставьте запрос на редактирование объекта

Спасибо за обращение

Our managers will contact you shortly

Сообщить об ошибке

Оставьте запрос на исправление ошибки

Advertising on the portal

Advertising on the portal

Email

Email

Website

Website