Xchange is a crypto exchange service for exchanging cryptocurrencies and withdrawing to fiat.

Crypto exchangers Xchange -

today is a day off

-

Monday- - -

-

Tuesday- - -

-

Wednesday- - -

-

Thursday- - -

-

Friday- - -

-

Saturday- - -

-

Sunday- - -

Are you the owner?

- m.«Moscow-City» 4 min. walk

- m.«Business Center» 6 min. walk

Xchange

Xchange — crypto exchange service overview

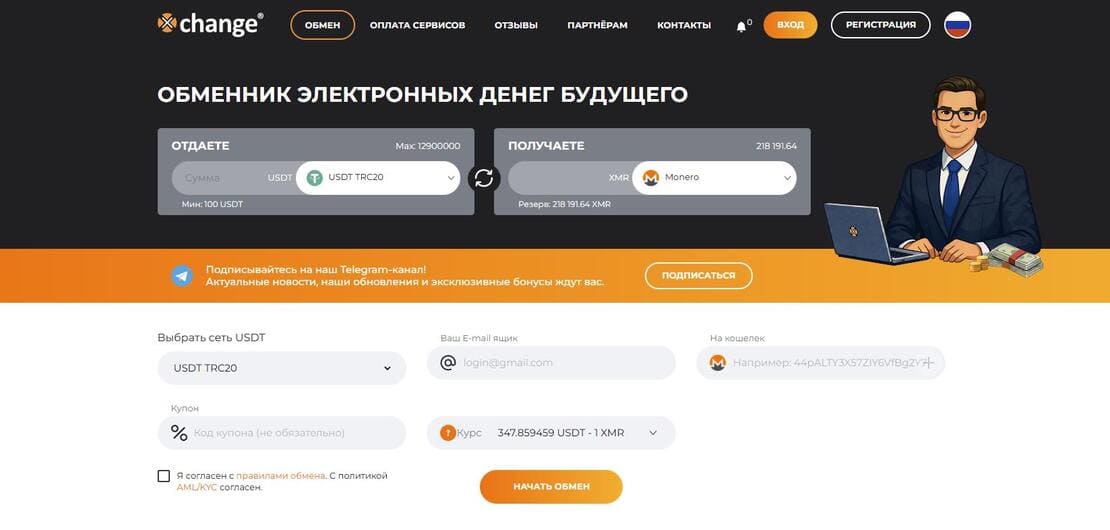

Xchange is a cryptocurrency exchange service used to convert digital assets between each other and to perform transactions in the “crypto ↔ fiat” directions. This format is usually chosen when you need to exchange popular coins and stablecoins, withdraw funds to bank details, or buy cryptocurrency via card/transfer without complex exchange mechanics.

On exchanger aggregators, services of this type are evaluated by practical parameters: exchange rate terms and rate fixation, clarity of fees, limits and reserve availability for specific directions, processing speed, and support accessibility. It is also important to consider security rules and how AML checks are handled, because these factors most often affect the predictability of the result.

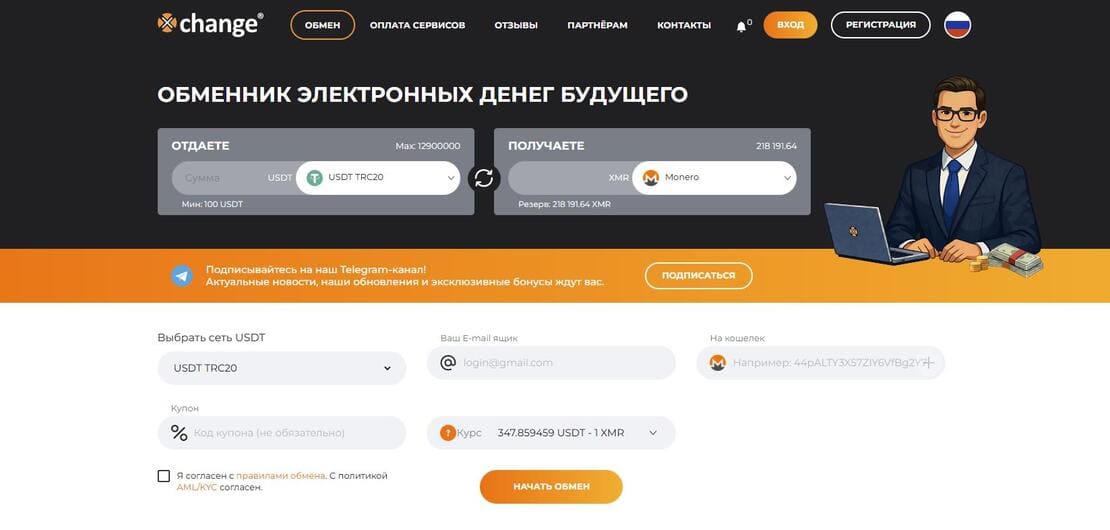

Exchange directions and USDT specifics

The exact list of assets and pairs may change, however, in most cases Xchange focuses on the most in-demand scenarios: crypto-to-crypto exchanges (for example, BTC, ETH, USDT, and other common assets), as well as fiat-related operations — withdrawals to a card or bank transfer and purchasing cryptocurrency using bank details. If you need to exchange rare coins or specific networks, it is better to check the direction availability in advance at the time of creating an order, since exchangers typically focus on liquid assets.

USDT requires special attention. This stablecoin is more common than others, but it operates on different networks — TRC20, ERC20, BEP20 — and the chosen network affects the fee, speed, and risk of mistakes. TRC20 is often used due to lower network fees and fast transfers, ERC20 belongs to the Ethereum network and can be more expensive during high congestion, while BEP20 is convenient within the BNB Chain ecosystem. The key rule is simple: the sending network must match the receiving network, otherwise the transfer may be delayed and require additional verification.

How the exchange works: step-by-step

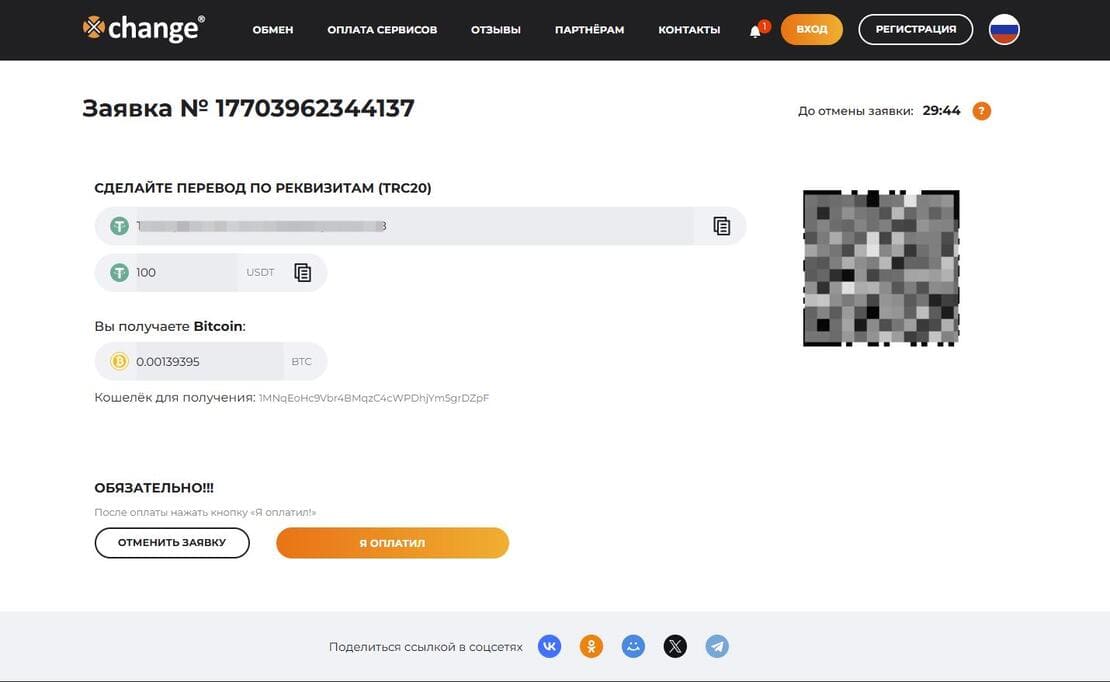

The exchange process in Xchange is typically built on a standard flow: the user selects a direction, enters the amount, provides the required details, and confirms the terms, after which they complete the transfer. After that, you only need to wait for network confirmations (if sending cryptocurrency) and the payout completion for the chosen direction. Exchange rate conditions may differ: in some directions the rate is fixed for a limited time, while in others a floating mechanism is applied until the funds are received.

- Select the exchange direction (for example, crypto → crypto or crypto → bank) and enter the amount.

- Check the limits for the chosen direction and fill in the recipient details (wallet address or bank details).

- Review the rate terms and confirm the order, then send the funds to the order details and track the status until the funds are credited.

Before sending funds, it is important to double-check the network (especially for USDT), the address/details, the final amount to be received, and the rate fixation time. If the direction requires a payment reference or matching recipient data, it is also better to verify these fields in advance to avoid delays on the bank side.

Rates, fees, speed, security, and AML

When comparing exchangers, it is reasonable to look at the final amount and conditions rather than only the rate shown in the list of directions. The result is influenced by network fees (which do not depend on the service and can vary significantly), possible exchanger fees, as well as limits and reserves. If the reserve for the chosen direction is limited, processing may take longer — this is a normal situation for popular pairs and fiat operations, especially during periods of high demand.

Exchange speed depends on several factors: blockchain congestion and the number of confirmations, as well as bank regulations and transfer processing times. Therefore, delays do not always indicate a problem — sometimes the cause is on the network or bank side. In such cases, it is critical that the order has a clear status and that you can clarify details via support.

From a security standpoint, the basic rules are the same for any service: only visit the xchange official exchange website, carefully check the domain, avoid suspicious links, and do not send funds to details that are not specified in the order. If you receive messages about changed payment details via third-party channels, treat them as potential phishing and verify information only through official sources.

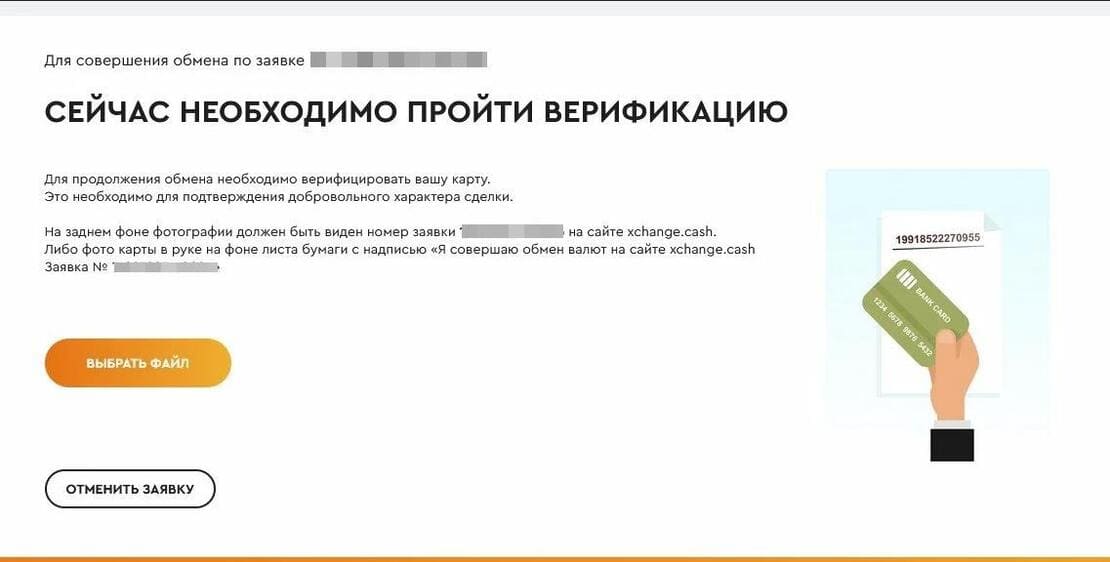

AML checks (Anti-Money Laundering) are standard market practice and may be applied to incoming transactions. If funds have a risky history (for example, linked to fraudulent schemes, sanctioned addresses, mixers, or darknet flags), the order may be subject to additional review. In such cases, the service may request identity verification (KYC) or documents/explanations regarding the source of funds. To reduce the likelihood of delays, it is usually recommended to avoid mixer services, not accept transfers from suspicious counterparties, and use wallets with a clear transaction history.

Who Xchange may be suitable for

Xchange is most often used for typical tasks: crypto-to-crypto exchanges, cashing out stablecoins into fiat, and buying cryptocurrency via a bank. In practice, users often search for xchange exchanger or xchange cryptocurrency exchanger to compare current terms and available directions. A common practical query is how to exchange usdt to sberbank xchange — this refers to the scenario of withdrawing USDT to bank details, where it is especially important to choose the correct network, carefully enter the data, and track the order status until the funds are fully credited.

Ask a question to a company representativeBeen here?

Leave your review of your visit.

Thank you for your review

It will appear on the site soon after moderation

Оставьте заявку

Мы подберем лучшие объекты из базы.

Leave a request

We will select the best objects from the database.

Thank you for your request

Our managers will contact you soon

Leave a request

We will select the best objects from the database.

Thank you for your request

Our managers will contact you soon

Запрос на редактирование

Оставьте запрос на редактирование раздела

Получить доступ

Оставьте запрос на редактирование объекта

Спасибо за обращение

Our managers will contact you shortly

Сообщить об ошибке

Оставьте запрос на исправление ошибки

Advertising on the portal

Advertising on the portal

Email

Email

Website

Website