Big City is a large-scale project for the development of territories around the Moscow-City International Business Center.

This is a concept for expanding the capital's business cluster into adjacent areas to create a multifunctional "urban heart" outside the historical center.

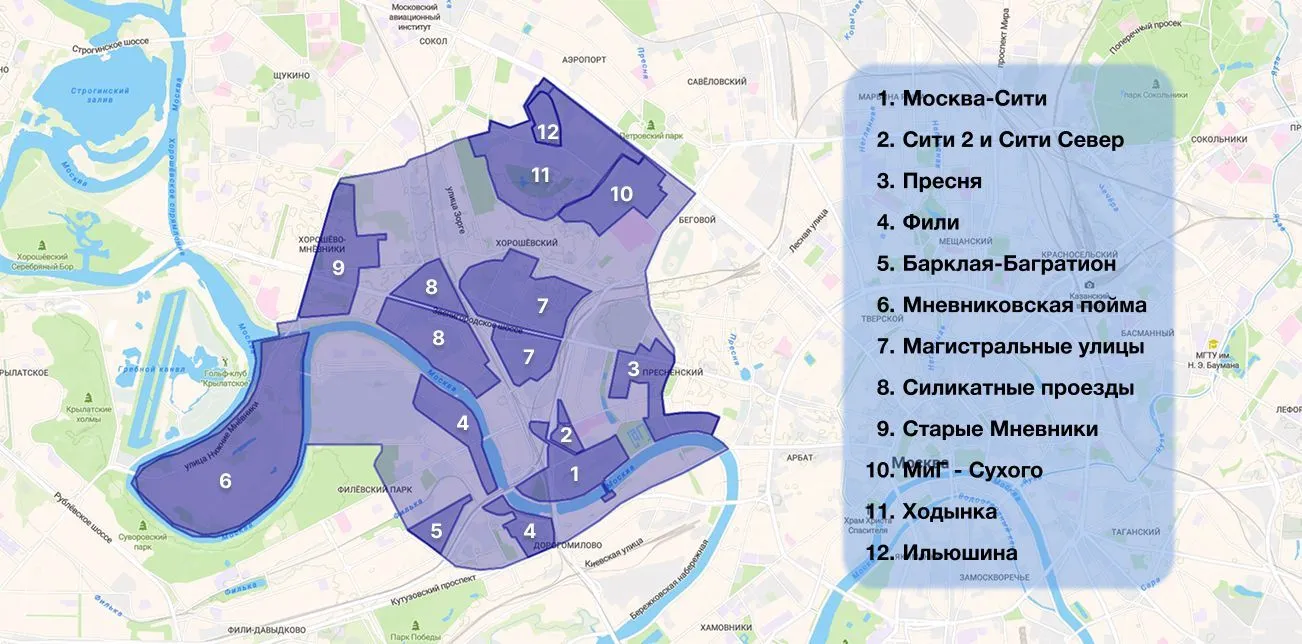

The territory of the Big City covers more than 3,200 hectares in five districts of Moscow (four administrative districts) and includes both already formed business zones (for example, the Moscow-City International Business Center itself) and former industrial areas subject to reorganization.

The idea for the Big City emerged back in 2005, when it became clear that the initial Moscow City project was successful and the business center needed to be scaled up.

By 2006, the City Planning Council under the Mayor approved the concept of the "Big City", and the withdrawal of industry from this zone began.

In 2014, the Genplan Institute developed a development plan for the expanded area, and in 2020, Mayor Sergei Sobyanin announced a shift toward the active development of the Big City. Essentially, Moscow has embarked on a course toward polycentric development: it is envisioned that within 10-15 years, alongside the historic center and the future center at ZIL, the Big City district will become one of three equally significant urban centers in terms of economic concentration, jobs, and attraction for people.

The Big City boasts a mixed development: modern office towers, residential complexes, shopping and entertainment centers, and social infrastructure combine to create a comfortable urban environment.

*materials from the leading Russian company Commonwealth Partnership were used

A key feature is that many new projects are being developed as mixed-use complexes (MFCs), combining residential, office, retail, and public spaces. This "corrective" approach addresses the shortcomings of the original Moscow-City (which initially lacked a residential environment and street activity) and creates year-round public spaces, diverse street retail, high-quality housing, and high pedestrian activity. As a result, Greater Moscow City is emerging as a new business cluster for Moscow, with enormous potential for investors and developers.

Urban development and infrastructure

The boundaries of the Big City are not officially defined, but they conditionally cover large territories in the areas of Presnya, Khodynka, Filey, Shelepikha, Khoroshevo-Mnevniki, Shchukino and others, connected by a transport framework with the core at Moscow City.

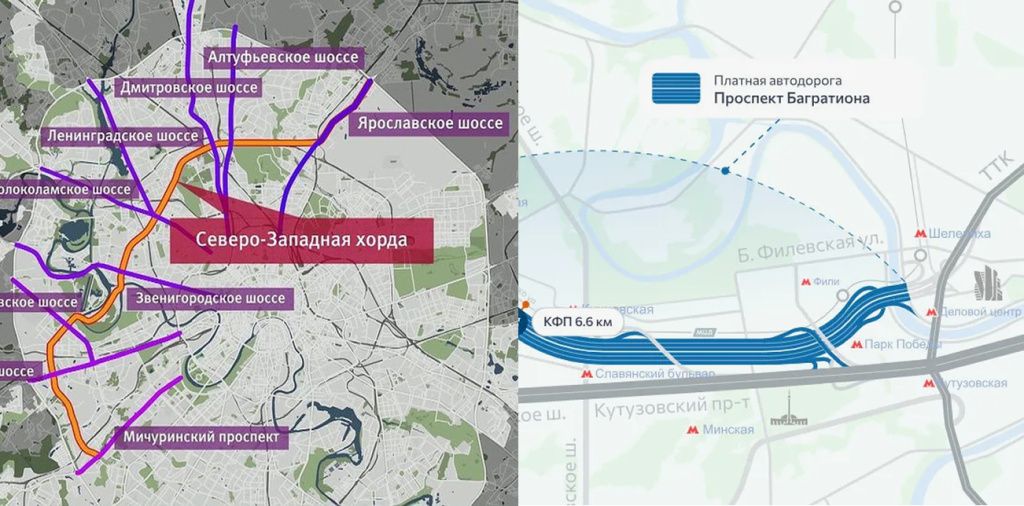

Over the past few years, the city has implemented a number of key infrastructure projects enhancing the connectivity of the area. Among those already completed are the launch of the North-West Chord highway (which has significantly eased local traffic congestion) and the construction of Bagration Avenue, which extends westward from the Moscow City center.

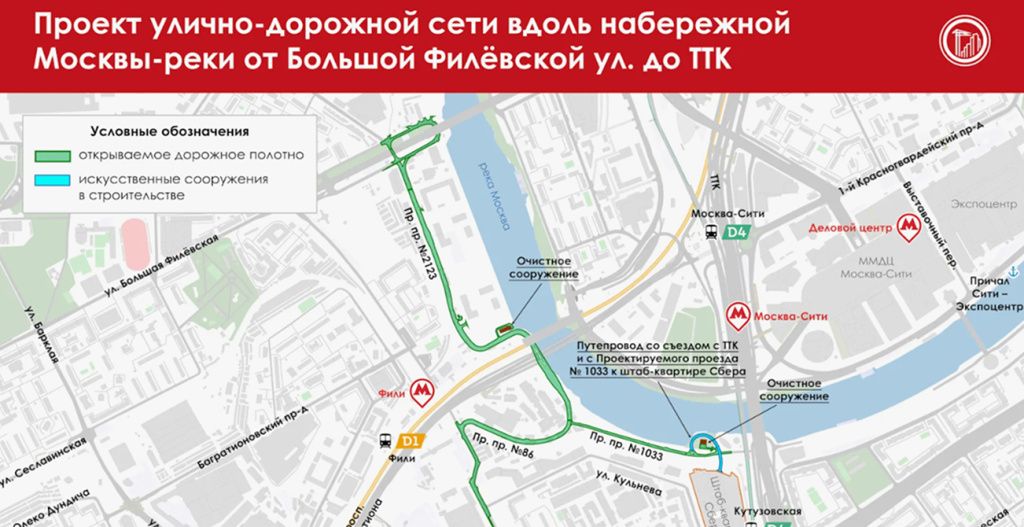

In September 2024, construction of a new 3.5 km long road connecting Bolshaya Filevskaya Street with the Third Ring Road was completed, and in December 2024, construction of a new automobile bridge on Myasishchev Street was completed.

New transportation projects are planned for 2025–2027: two automobile bridges are planned to open across the Moskva River: the Academician Korolev Bridge (along Beregovoy Proezd, expected to open in 2025) and the bridge on Novozavodskaya Street (by 2026). A pedestrian bridge is also planned between Presnenskaya and Taras Shevchenko embankments near the business center, which will improve pedestrian connections between Moscow City and the opposite bank. The metro and urban rail transit networks are also being developed.

In recent years, new stations have opened in the Big City and within its immediate vicinity, including stations on the Big Circle Line (Shelepikha, Khoroshevskaya, Narodnoye Opolchenie, and others), the extension of the Filyovskaya metro line to Delovoy Tsentr, and the opening of the Moscow Central Diameters (MCD) lines. Further improvements to transportation services are expected in the coming years (for example, a new line to Rublevo-Arkhangelskoye with several stations in Mnevniki is planned).

These projects, taken together, form a modern transport backbone for the Big City, connecting all its parts and the rest of Moscow. Improving transport accessibility is a necessary prerequisite for the intensive development of this vast territory.

In addition to transportation, the city is implementing embankment improvement programs (approximately 4 km of new embankments have been built and are being planned along the Moscow River as part of the Big City project) and street reconstruction. As a result, previously disparate industrial zones and vacant lots are receiving roads, bridges, and utility lines—the foundation for future development.

The program to reorganize Moscow's industrial zones also played a significant role: since the 2010s, a significant portion of the factories located there have been relocated or closed, freeing up vast areas for new construction.

Clusters and territorial development

Because the Greater City's territory is so vast, its development is taking place in clusters—distinct development nodes that then merge into a more cohesive urban fabric. Seven main clusters can be identified:

-

MIBC "Moscow-City" is the original core, 60 hectares of skyscrapers in the Presnensky district.

-

Khodynka is the area of the former Khodynka Field and the surrounding area up to Leningradsky Prospekt (the corridor of the Dynamo-CSKA-Polezhaevskaya-Voykovskaya metro stations).

-

Zvenigorodsky (or "City-2") is the area along the Zvenigorodskoye Highway and the Small Ring of the Moscow Railway (Testovskaya, Shelepikha), including part of Khoroshevo-Mnevniki.

-

Kutuzovsky – a section along the extension of Kutuzovsky Prospekt and the areas adjacent to it (for example, the area of the Shelepikhinsky Bridge, Presnenskaya Embankment west of the City).

-

Fili-Mnevniki is the western part of the Big City, including the former industrial zone of the Khrunichev plant and the areas of Fili Park and Nizhnie Mnevniki on the northern bank of the Moskva River.

-

Presnya – the quarters of the Presnensky district adjacent to the business center (Krasnaya Presnya, Shmitovsky proezd, etc.) with mixed historical buildings.

-

Oktyabrskoye Pole is the most remote northwestern fragment (the area of the Oktyabrskoye Pole and Narodnoye Opolchenie stations), where new projects are also planned.

Each cluster is at a different stage of development. Moscow-City is an established premium business cluster with high-rise buildings and well-developed infrastructure. Khodynka has recently transformed into a vibrant residential area (home to Europe's largest shopping mall, Aviapark, and the large residential complexes Grand Park, Legend of Tsvetnoy, and Park of Legends, among others), as well as office centers around the CSKA and Polezhaevskaya stations).

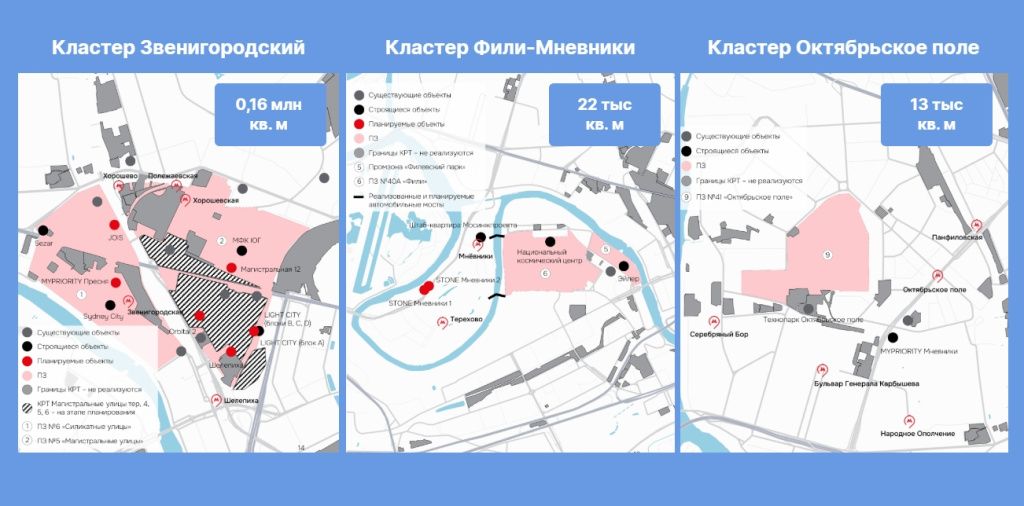

The Zvenigorod cluster is still less developed – these are former industrial zones along the railway and highway, where new facilities are only just beginning to be built (however, a large complex, the National Space Center in Fili, has already been created).

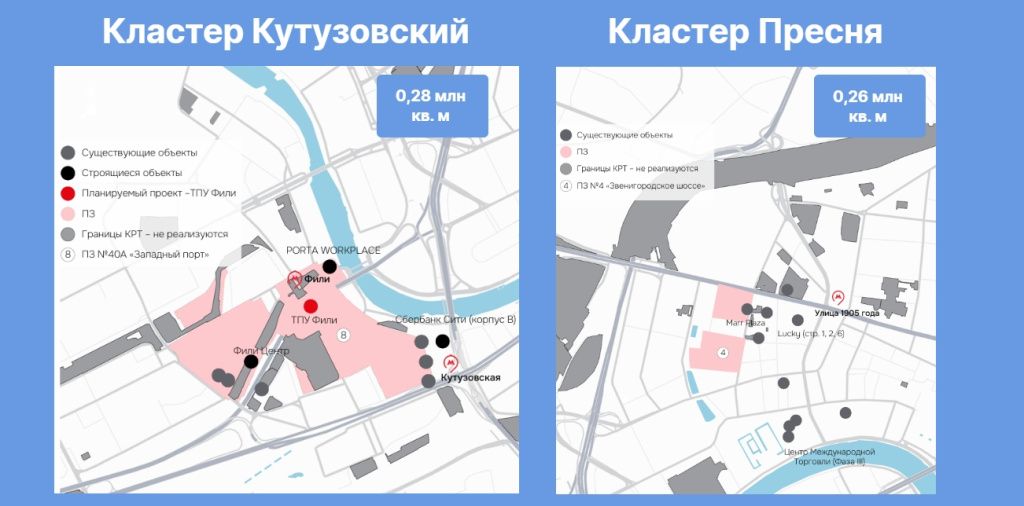

The Kutuzovsky cluster includes projects along the new highway – the Porta Workplace and Sberbank City business centers (Sberbank campus) are being built here, and a new point of attraction is being formed near the Shelepikha Moscow Central Circle station.

Fili-Mnevniki is a vast area of former factory and wasteland, where development is just beginning: in addition to the aforementioned Space Center (Roscosmos headquarters), new residential areas and office parks are expected to be built under the KRT program.

Presnya has already been partially renovated (the elite residential complex "Lucky" and other complexes have been built on the site of old factories), but overall it remains an "old town" with spot development.

Oktyabrskoye Pole is a small subcluster where a technology park has emerged, and development around new metro stations is possible in the future.

It's important to note that the Moscow-City cluster initially dominated the Greater Moscow region, accounting for approximately half of the total available real estate. However, with the launch of projects in other hubs, the Moscow-City cluster's share will decline.

Analysts are introducing the concept of a "metrocommune" —an area around one or more nearby metro stations that acts as a center of attraction. The Moscow-City metrocommune currently accounts for approximately 50% of the office space in the Greater Moscow Region. Another 9% is accounted for by the "metrocommunes" of the Leningrad Corridor (Dynamo-Voykovskaya stations, i.e., the Khodynka cluster). The remaining clusters currently account for only 40% combined.

By 2030, the picture will change significantly: Moscow-City's share is projected to decline to ~41%, the Leningrad cluster to 6%, and more than half (approximately 53%) of office space will be located in new business hubs that are currently under development. In other words, the Greater City will diversify and acquire several relatively equal growth centers instead of concentrating them in a single location.

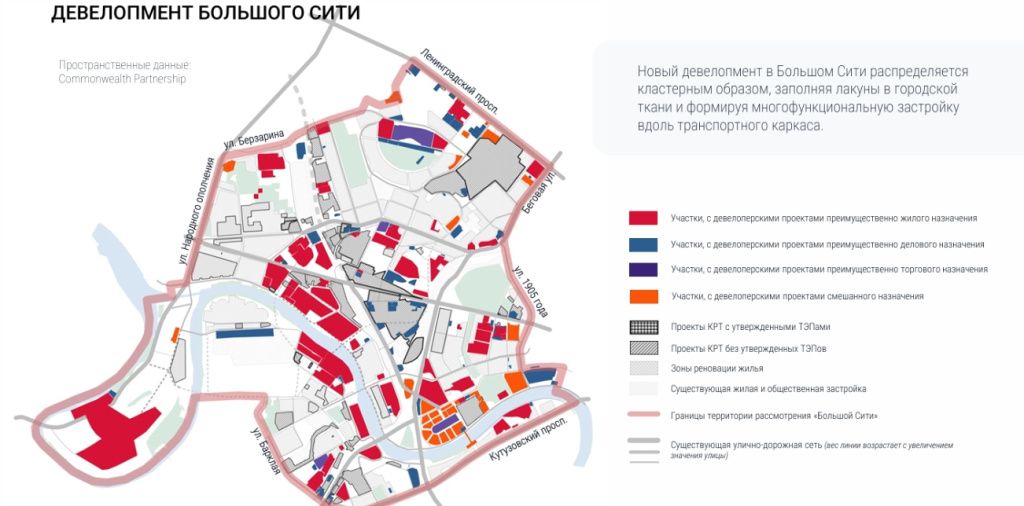

The Big City development model itself is polycentric and multifunctional. New buildings "fill gaps"—previously unused spaces—and gradually stitch together districts into a unified urban fabric. Moreover, development is taking place along key transportation axes (highways, metro lines, the Moscow Central Circle), ensuring easy accessibility. This approach is consistent with Moscow's current strategy of redistributing business activity from the congested historical core to new centers on the outskirts, while creating comfortable living and working conditions in the new clusters themselves.

Office real estate

By the end of 2024, the total volume of operating office space in the Greater Moscow Region is estimated at approximately 2.8 million square meters—roughly 13% of Moscow's total office stock. By comparison, the Moscow International Business Center Moscow-City alone contains approximately 1.56 million square meters of office space (primarily Class A/Prime), more than half of the entire Greater Moscow Region.

Other significant office hubs today are Khodynka (~0.56 million sq. m) and Presnya (~0.26 million sq. m), as well as the Kutuzovsky cluster (~0.28 million sq. m).

The new clusters are still relatively small: Zvenigorodsky has only ~0.16 million square meters of operating office space, Fili-Mnevniki has a few thousand (around 22,000 square meters), and Oktyabrskoye Pole has around 13,000 square meters. Thus, today the office market in Moscow City is concentrated primarily in the skyscrapers of Moscow City and a few large business centers in other districts. Moreover, approximately 80% of this space was commissioned before 2014, meaning a significant portion of the properties are already becoming obsolete. At the same time, demand for high-quality space is high, as evidenced by the record-low vacancy rate: only ~1.5% in Moscow City on average (compared to ~4.5–5% in Moscow).

In some clusters, the vacancy rate approaches zero—for example, in the Presnensky (0.1%) and Kutuzovsky (0.6%) districts. Even in Khodynka and Zvenigorodsky districts, only ~2% of offices are vacant; the only cluster with a slightly higher vacancy rate is Oktyabrskoye Pole (~4.3%, which is still low). This situation limits the options for tenants and simultaneously signals to developers the significant potential for new construction.

Accordingly, the Greater City is currently experiencing a period of active growth in office real estate supply. 2025 will be a turning point in many ways: several large business centers are expected to open. These include the new headquarters of the Roscosmos State Corporation (approximately 200,000 square meters of office space) as part of the National Space Center (Fili-Mnevniki) and the Space Tower of the iCITY project in Shelepikha (91,000 square meters of office space). These two projects alone will add almost 300,000 square meters of prime space, equal to half of all current construction. In total, as of early 2025, 14 office projects with a total area of approximately 587,000 square meters are under construction in the Greater City.

In addition to those already mentioned, the following business centers are expected to open in the coming years: Porta Workplace (27,000 sq. m on Kutuzovsky), Fili Park (approximately 21,000 sq. m), several facilities in Khodynskoye Pole (projects by the STONE company - two stages of ~45–65 thousand sq. m, the AIR project from Tekta Group for 91 thousand sq. m, etc.), the Oktyabrskoye Pole technology park (7,000 sq. m, opened in 2024), and a number of others.

However, construction is only part of the story. The bulk of the new office space is still in the design stage: as of January 2025, 17 projects with a total office space of approximately 1.4 million square meters have been announced but have not yet begun construction. Many of these are large-scale integrated developments planned under territorial reorganization programs (TRPs). For example, major TRP projects have been approved in the Khodynka and Zvenigorodskoye clusters, encompassing approximately 2 million square meters of non-residential development (a significant portion for business functions). As these projects are implemented, the business landscape of the area will change dramatically over the next 5-10 years.

Experts estimate the total potential of the Greater Moscow office market at nearly 6.8 million square meters by 2035. This means the existing stock could more than double. The largest growth areas are the Khodynka and Zvenigorodsky clusters: by 2035, each is expected to have approximately 1.6–2.1 million square meters of office space (for comparison, this is comparable to the current capacity of the entire Moscow-City International Business Center). For example, Khodynka, thanks to the development of the former airfield and adjacent industrial zones, will increase its office stock by approximately 3.7 times over 10 years, while the Zvenigorodsky zone will increase it by almost 10 times. Khodynka is projected to equal Moscow-City in terms of the volume of high-quality offices, becoming one of the largest and most developed business locations in Moscow. Other clusters will also grow: in Fili-Mnevniki, from zero to approximately 0.3 million square meters, and on Kutuzovsky, to approximately 0.34 million square meters. Only Presnya will remain without significant growth (limited by dense, existing development). Overall, these figures indicate the creation of approximately 4 million square meters of new office space in the northwestern sector of the capital over the next 10-15 years—effectively another "City."

Along with the volume, the class of projects is also growing: new business centers are being announced in the high-end Class A and Prime segments, featuring modern architectural solutions, flexible layouts, eco-standards, and more. This will attract numerous tenants who currently find the old city center cramped and expensive. Speaking of prices: as of early 2025, the average asking rental rate in Big City was approximately 34,000 rubles per square meter per year (triple net, excluding VAT and operating costs), which is comparable to the Moscow average for Class A. However, within the submarket, the range is wide: in the Moscow City towers, rates reach 50,000–55,000 rubles per square meter per year, while in other clusters they are lower—for example, in Khodynka ~37,000, in Zvenigorodsky ~45,000, and in Presnya ~37,500. This differentiation reflects the differences in the prestige, quality, and location of the properties. As new premium projects emerge outside the Moscow International Business Center (MIBC), this gap can be expected to narrow. Income potential is also important for investors: given the low vacancy rate, high-quality office properties in the Moscow City district provide a stable flow of tenants. Record-breaking lease and purchase transactions are possible here in the coming years – international corporations and state-owned companies are already choosing this location (for example, the relocation of the Roscosmos headquarters). At the same time, the flexible office and coworking segment is developing: at least 15 serviced office spaces are already operating in the Moscow City towers alone, and new ones are appearing in other business centers in the Moscow City district, reflecting the trend toward flexible workspaces.

In summary, the Greater City office market is entering a phase of rapid growth, while remaining highly attractive to investors: demand exceeds supply, rates are high, projects are supported by the city, and the prospects are enormous – this area is becoming Moscow's second business hub.

Residential real estate

The residential component is an integral part of the concept of Big City as a multifunctional district. A significant number of people already live here, and new residential neighborhoods are emerging. The total area of existing housing within Big City is estimated at approximately 4.7 million square meters (including apartments in residential buildings and the residential portion of the mixed-use complex). This includes thousands of apartments – both in the preserved Soviet-era buildings and in new construction of recent years. A distinctive feature of Big City is the high density of modern residential development: since the mid-2010s, the district has experienced a construction boom of comfort- and business-class residential complexes. Between 2016 and 2024 alone, hundreds of thousands of square meters of housing were commissioned annually in this area – a total of approximately 2–2.5 million square meters over eight years. Initially, developers developed the most attractive vacant sites (for example, on Khodynka Field, in the Western Port, etc.), then the focus shifted to the redevelopment of industrial zones.

As noted, many residential complexes in the Big City are being built as mixed-use developments, integrating commercial and public functions. For example, Capital Group's "Heart of the Capital" project, built on the site of a precast concrete plant in the Shelepikha district, is a block of skyscrapers with its own shopping promenade along the embankment. The "Lucky" (Vesper) residential complex in Presnya was built on the site of a former paint and varnish factory and includes not only luxury apartments but also offices, restaurants, and a museum. The Khodynka Field development combines residential towers and large retail facilities (Aviapark, supermarkets, and fitness clubs). This approach provides residents with access to services and leisure activities within walking distance and creates vibrant street retail on the ground floors. Essentially, the Big City is developing a modern "15-minute city" urban environment, where basic needs—housing, work, shopping, and a park—are all located close to one another.

As a result of active housing construction, Big City can already be considered one of the largest residential areas of Moscow outside the Moscow Ring Road. And this trend will continue: the total area of housing announced by 2030 in this area is estimated at approximately another 4.7 million square meters. In other words, the housing stock is planned to essentially double, adding dozens of new buildings. This volume will be formed by both completely new projects and phases of already launched complexes. Among the largest developers who have announced projects in Big City with completion by 2030 are PIK Group, MR Group, Capital Group, STONE Hedge, Granel, RG-Development, and others (each with a portfolio of 200,000 to 500,000 square meters of housing in this location). For example, new phases of a residential cluster from PIK are planned near the park on Khodynka; In Khoroshevo-Mnevniki, MR Group is developing the former Silikatny industrial zone; in Fili, residential quarters will be built as part of the Berezhkovskaya Embankment – Ilyushin Street development project; in Oktyabrskoye Pole, RG-Development is building an extension of the technology park with a residential component, and so on. The Construction Department is also implementing a renovation program for five-story buildings (see below) in the Presnya and Shchukina districts, which will also add new modern residential buildings.

The quality and format of residential offerings in the Big City generally correspond to current trends in the capital's market: comfort- and business-class projects predominate, often conceptual neighborhoods with their own architecture and infrastructure. Building heights vary – from the supertalls of Moscow-City (85+ stories) and the 30-45-story towers of Khodynka to more modest 15-20-story complexes on the sites of industrial zones (in accordance with urban development regulations near embankments and parks). Considerable attention is paid to the improvement of courtyards and public spaces: new residential areas are receiving parks (for example, the 24-hectare landscape park at Khodynskoye Field has already become a magnet for residents), pedestrian boulevards (General Karbyshev Boulevard in Shchukino is scheduled to open by 2027), and landscaped embankments (the planned renovation of Karamyshevskaya and Presnenskaya embankments). All this enhances the comfort of living and the prestige of the location, which is reflected in housing prices: for example, luxury apartments in the Moscow City skyscrapers cost from 1 million rubles per square meter, business-class apartments in Presnya cost 500,000–700,000 rubles per square meter, and comfortable apartments in Khodynka cost 300,000–400,000 rubles per square meter. Despite the high prices, demand remains consistently high, especially among young professionals, employees of nearby offices, and investors who view such apartments as a liquid asset. As the Greater City's business functions develop, the residential component will only strengthen, forming a full-fledged "live and work" cluster, reducing commuting and creating a new way of life in Moscow.

Retail real estate

The formation of a new urban agglomeration is impossible without retail infrastructure, and Moscow City is already serving as a powerful retail and entertainment cluster in this regard. The total area of operating retail facilities (shopping malls, shopping galleries in mixed-use complexes, street retail) is estimated to be approximately 960,000 sq. m (GLA). The largest facilities include: Aviapark Shopping and Entertainment Center (390,000 sq. m total, ~230,000 sq. m leasable area, opened in 2014), the largest mall in Europe, located on Khodynka; Afimall City Shopping and Entertainment Center in Moscow City (~185,000 sq. m total, opened in 2011); Horosho! Shopping and Entertainment Center near Polezhaevskaya metro station (136,000 sq. m, opened in 2018). The Filion shopping mall on Bagrationovsky Prospekt (120,000 sq. m); the Shchukinskaya transport hub (65,000 sq. m, opened in 2021), and others. Furthermore, hundreds of shops, restaurants, and service outlets are located on the ground floors of residential and office complexes—this segment is known as street retail. Traditional large shopping malls and stand-alone shopping complexes account for approximately 52% of the total area, while street retail accounts for approximately 48%, indicating a balanced format. It is noteworthy that approximately half of all street retail spaces are integrated into residential complexes (≈46% of street retail space), another ~38% are in multifunctional complexes, and only 16% are in purely office buildings. These figures illustrate the previously mentioned trend: new residential projects in the Big City are maximizing retail functionality, creating walking distance to stores for residents and employees.

*materials from the leading Russian company Commonwealth Partnership were used

The main shopping areas are currently concentrated in developed clusters: Khodynka (in addition to Aviapark, there are numerous cafes, shops, and an Auchan hypermarket along Khodynka Boulevard), Moscow-City International Business Center (in addition to Afimall, there are underground shopping galleries in the towers and restaurants on the embankment), the Silikatnye Proezd and Magistralnye Ulitsa area (Khoroshevo, Presnya – home to such facilities as the Expo-Lebed Shopping Center, the Presnensky Market, and others), Fili (the Filion Shopping Center and adjacent street retail), and also in spots around the metro stations. By 2030, retail infrastructure will expand to new locations: shopping malls and stores will appear in areas of the Zvenigorod cluster (for example, a shopping gallery is planned as part of the iCITY-2 project and other mixed-use developments in Shelepikha), in Mnevniki (new neighborhoods will include space for supermarkets and services), and within the City-2 North area (near the Khoroshevo Moscow Central Circle station). At least 362,000 square meters of new retail space has already been announced for completion by 2030. This represents only the amount publicly announced by developers; the actual volume could be greater, given upcoming KRT projects. Thus, the total retail space potential of the Greater City will exceed 1.3 million square meters in the coming years, which is comparable to the capacity of an entire Central European city.

Retail formats are also evolving. Developers are increasingly opting for smaller formats integrated into the urban environment, rather than giant shopping centers. New projects in Big City feature ground-floor galleries with separate street entrances, outdoor restaurants, weekend farmers' markets, and new types of entertainment (VR parks, sports clusters). Traditional malls, of course, won't go anywhere—Aviapark and Afimall are operating successfully and attracting crowds. But future growth in retail real estate will come from street retail and stand-alone retail facilities (retail parks, supermarkets, and showrooms) within new neighborhoods. This is confirmed by the current structure: in 2024–2025, the shares of street retail and traditional shopping centers in the total volume of new developments in Big City will be virtually equal.

Overall, the consumer infrastructure already makes Big City a self-sufficient district: residents and workers can find everything they need here – from groceries and household goods to fashion boutiques, from cafes and food courts to movie theaters and fitness centers. With further occupancy of new residential complexes and the growth of the office population, the market's capacity will only increase, opening up additional opportunities for retail investors and operators. It's no coincidence that major retail chains are actively leasing space in Big City's new developments, and the price of ground-floor retail in some locations (for example, in Moscow City or near the CSKA metro station) is reaching premium levels.

KRT and renovation programs

The main development resource for the Big City is the vast territories of former industrial zones, which are gradually being brought into use. To systematically manage these territories, the city launched a mechanism for integrated territorial development (ITD). Within the Big City boundaries, IDT projects totaling approximately 480–645 hectares have been approved (estimates vary, as some sites are still under development). Of these, approximately 164 hectares are already in the planning or implementation stages—14 IDT projects where development parameters have been defined, an investor or operator has been selected, and work has even begun. The numerous remaining industrial zones currently only have established IDT boundaries, but detailed planning projects for them have not been approved. Nevertheless, the very designation of the Big City as a single project (since 2014) and the activation of the IDT mechanism have provided a powerful incentive: developers have gained an understanding of the rules of the game and the opportunities in this location.

The KRT in the Greater City encompasses areas such as the Khrunichev Plant site (Fili-Mnevniki), the Bratsevo and Oktyabrskoye Pole industrial zones in Shchukino, industrial zones along Zvenigorodskoye Highway (Berezhkovskaya, Presnya-Sever, etc.), neighborhoods near Baltiyskaya Street and Grazhdanskaya metro station (Khodynka-Sever), and many others. The KRT envisions integrated development with a change in the land's functional use: outdated manufacturing facilities will be replaced by residential areas, office and business centers, technology parks, and social facilities. It is estimated that the KRT projects already outlined in the Greater City could yield approximately 3.9 million square meters of office space and comparable volumes of residential and commercial real estate. The KRT is implemented in three ways: either through a private investor selected through a tender (the classic scenario is when the city enters into a KRT agreement with a developer who undertakes to develop the territory); or through a so-called operator (an entity with a city stake of ≥50%, which can develop independently, attracting investors without a tender); or at the initiative of the landowners (if the owners themselves are willing to act as developers, entering into an agreement with the city). In the Big City, examples include the Presnya KRT project (implemented by the operator, JSC Moscow Center for Urban Development, with the participation of the city), the Bratsevo KRT (initiated by the copyright holder, the Samolet Group), the KRT in Khoroshevo-Mnevniki (implemented by the investor, the Etalon Group), and others. Thus, the mechanism is sufficiently flexible, allowing for the simultaneous launch of multiple sites.

In addition to the KRT, the housing renovation program launched in Moscow in 2017 plays a significant role. Within the Greater Moscow region, several neighborhoods with older housing stock (five-story buildings from the 1950s and 1960s)—for example, parts of the Khoroshevsky, Shchukinsky, and Presnensky districts—are being renovated. Over the next five to seven years, modern residential buildings, often higher in height and with commercial space below, will be built in these areas. The renovation program not only improves residents' living conditions but also increases the overall housing supply in the area (due to higher density development). Furthermore, it improves the appearance of the streets, as new buildings designed by renowned architects, featuring landscaped courtyards, parking, and social infrastructure (schools, kindergartens), replace dilapidated Khrushchev-era buildings. In the Big City, some initial buildings have already been commissioned for renovation (for example, on General Glagoleva Street in Khoroshevo), and large-scale renovations are expected in the coming years.

The synergy between the KRT and renovation programs ensures comprehensive development of the area: business facilities, housing, and public spaces are created simultaneously, leading to harmonious growth. At the same time, the city strictly controls the provision of roads, transportation, educational and healthcare facilities for new developments to ensure that new developments do not place an unbearable burden on the existing infrastructure. Investors receive city incentives, such as rent exemptions during construction, support for the relocation of utility lines, and rapid approval of planning projects. All this makes the transformation of the Big City more predictable and attractive for business.

Investment potential and prospects

The Greater City project is currently one of the most promising areas for urban real estate development in Russia. For developers, it offers a rare combination of factors: proximity to central Moscow and the availability of large vacant lots; government support (infrastructure and regulations); real, solvent demand for all types of real estate (offices, residential, retail); and economies of scale (a new cluster is emerging, capable of setting its own trends and price levels in the market). It's no surprise that virtually all major market players are already present or planning projects in Greater City. Capital Group, MR Group, PIK, Etalon, AFI Development, and state corporations such as Sberbank, Rostec, VEB, and others are all building here. Investments in existing projects alone amount to hundreds of billions of rubles, and future investment volumes are even greater.

For commercial real estate investors (funds, private equity), the Greater City is attractive as a new magnet for tenants. Office properties here are already demonstrating high yields thanks to a near-zero vacancy rate and rates approaching those of the central city. As the area expands, asset capitalization can also be expected to increase—as disparate neighborhoods are transformed into a single, prestigious location, the price per square meter will rise. At the same time, the entry barrier for investment is currently lower than in the historic center or within the Garden Ring, creating opportunities for price arbitrage. Investors who enter clusters early in their development (for example, the Zvenigorod or Filevsky clusters), capturing a low baseline land value, will particularly benefit. Over the next 10 years, when these areas are filled with modern development, a multiple increase in value can be expected.

For corporate tenants and companies, Moscow City is an attractive location for offices and retail outlets. Major structures are already based here (in addition to corporations in Moscow City, these include, for example, the headquarters of the Russian Football Union and the Mars office in Khodynka, Gazprom Neft and Severstal offices in Presnya, and others). Businesses have appreciated the advantages: modern space, status, convenience for employees (many live nearby or are willing to relocate), and an image of innovation. As new space is commissioned, companies will have more options for relocating from existing offices, spurring a wave of relocation within the city in favor of Moscow City. Similarly, retailers gain access to a growing audience of residents and workers: tens of thousands of people who need stores and services close to home or work. Developing Moscow City means forming a new consumer base, and those brands that are first to enter will be able to establish themselves on favorable terms.

Finally, for the city and society, the Greater City is a hub for economic growth and improved quality of life. Tens of thousands of jobs are being created (according to various estimates, up to 200,000-250,000 in the office sector alone by 2035). The district is receiving new schools, kindergartens, and clinics thanks to investors' commitments under the KRT. Former industrial zones, which previously polluted the environment, are being transformed into well-maintained neighborhoods and parks—the environmental impact and improvement of the urban environment are obvious. The development of the area also enhances Moscow's international appeal: a new city skyline is emerging, with skyscrapers not only in the City but also elsewhere, creating the image of a modern metropolitan agglomeration equal in scale to world capitals.

In conclusion, Big City can already be called Moscow's new business center, although it is still in its infancy. Its potential is enormous: in 10-15 years, we will see multi-million-dollar office and residential space, dozens of new high-rises, a well-developed road and metro network, and bustling streets lined with cafes and shops. This district will embody the "city within a city" concept, offering comfortable living, working, and leisure. Key development areas—integrated territorial development (ITD), the creation of transportation hubs, and mixed-use projects—will help avoid imbalances and the "ghost town at night" (a problem familiar from the early days of Moscow City). On the contrary, Big City is becoming balanced and vibrant. All this makes it one of the most attractive locations for investment and business in the coming decade. Moscow is forming a new urban heart in the northwest—and this "organism" is already beginning to pulsate, filling with people and projects, providing impetus for the development of the entire capital.

Related materials:

Real estate market overview in the "Big City"

The Big City Project: Features and Prospects

Moscow-City and the Greater Moscow Office Market: Analysis for 2024–2035

The Future of the Big City Business Cluster: Ambitions, Plans, and Prospects

Big City 2024: Real Estate Market Growth and New Horizons

The article uses materials from leading Russian companies Commonwealth Partnership and IBC Real Estate.

Advertising on the portal

Advertising on the portal

12441

12441