The state-owned transport monopoly Russian Railways (RZD) is preparing for one of the most high-profile transactions on the commercial real estate market: in February–March 2026, the company may announce a tender for the sale of office space in the Moscow Towers — one of the largest office complexes in Moscow City. Analysts estimate the starting price of the offering at no less than RUB 220 billion — significantly above the company’s initial investment, potentially making this project a record-breaking transaction for the Russian market.

Why did RZD decide to sell?

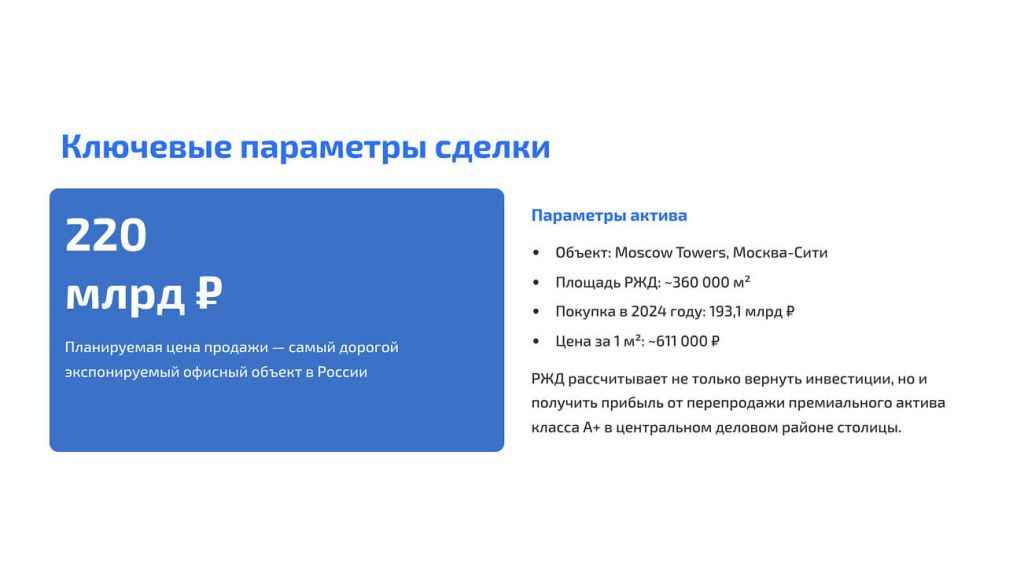

In 2024, RZD acquired approximately 350–360 thousand sq m in the Moscow Towers skyscraper, with a total area of about 400 thousand sq m, to accommodate its corporate headquarters — with the aim of consolidating a significant share of the holding’s staff and reducing operating costs. The transaction price amounted to RUB 193.1 billion, structured with a long-term payment schedule.

However, by the end of 2025, the Russian government initiated a broad discussion on the financial stabilisation of RZD amid a substantial debt burden — estimated at around $50 billion (≈ RUB 4 trillion). Support options include debt restructuring, budgetary mechanisms, and the sale of non-core assets, one of which became the decision to sell the towers in Moscow City.

Valuation and deal outlook

The starting price proposed by RZD exceeds the amount of the initial investment. According to sources, the holding aims to receive at least RUB 220 billion for the asset — reflecting a degree of market optimism regarding the master-planned positioning of the property within the capital’s business district.

Professional real estate market participants note:

-

A valuation of RUB 220 billion represents a high benchmark for the Russian office property segment, comparable to the largest transactions of recent years.

-

In terms of price per square metre, the asset can be compared with higher-priced transactions: for example, a recent major deal involving properties in Moscow City demonstrated prices per sq m comparable to those of Moscow Towers.

Challenges in finding a buyer

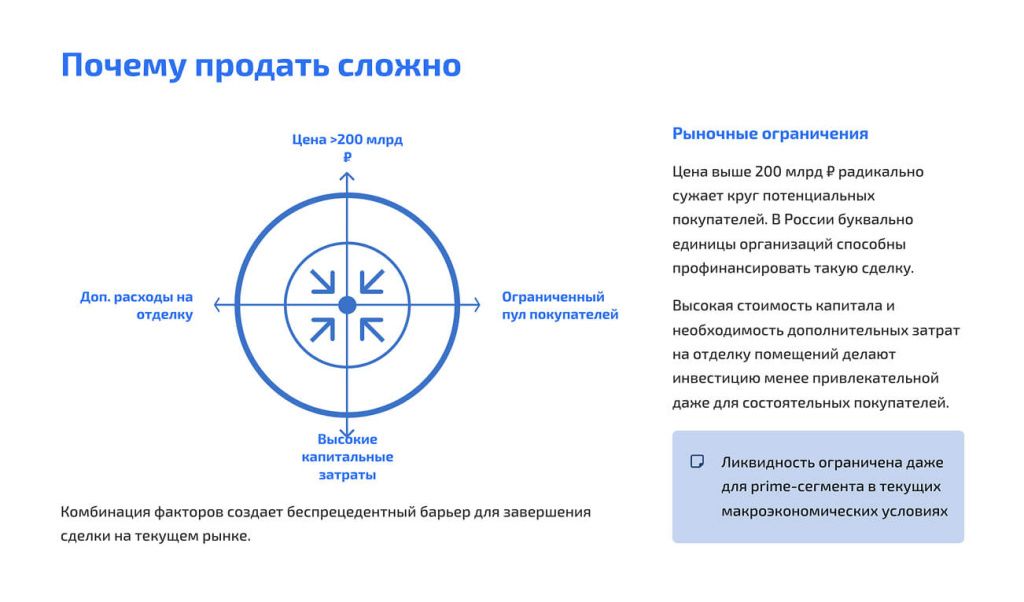

Despite the prestige of the location and its architectural dominance within the “Big City” cluster, experts warn of significant challenges in executing a transaction of this scale:

-

Amid moderate economic growth and a limited number of large capital-intensive investors, finding a single buyer willing to invest in an asset valued above RUB 200 billion is extremely difficult.

-

Even among private holdings, according to consultants, no more than five companies are capable of considering such an asset.

-

A potential buyer may also face additional costs for fit-out and space adaptation — preliminary estimates suggest this could add tens of billions of rubles to the overall budget.

Possible scenarios

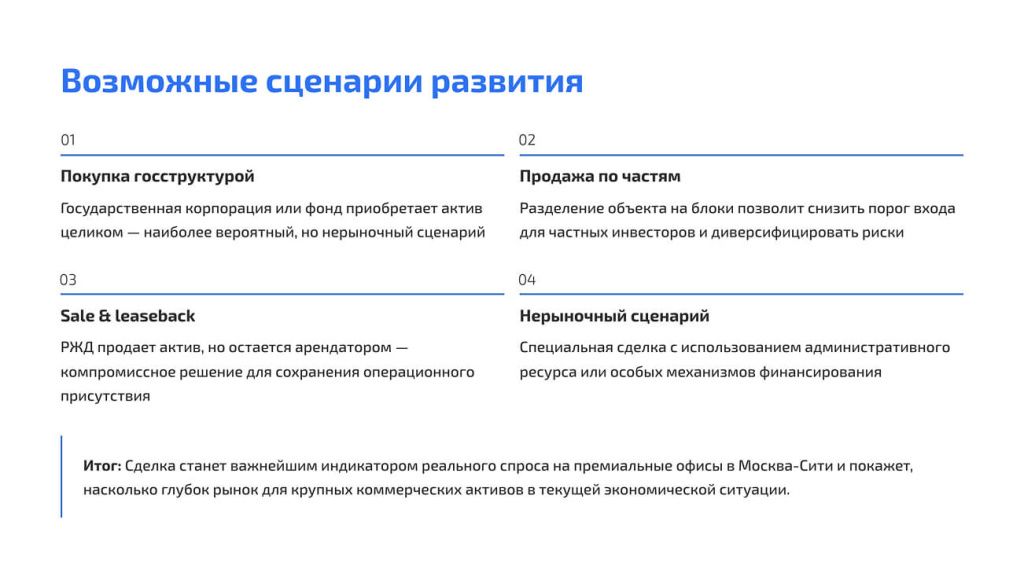

The market is considering several potential scenarios:

-

Sale of the entire complex to a single major investor — potentially a state entity or a large financial institution.

-

Sale in parts, dividing the space into large blocks to expand the pool of potential buyers.

-

Use of sale-and-leaseback structures or arrangements with continued involvement of RZD in asset management to ease the financial burden on the buyer.

What this means for Moscow City and the office market

If the transaction is completed at the stated price, it will become one of the largest turnovers in the history of Russia’s commercial real estate market, highlighting sustained interest in Moscow Towers as a flagship asset of the Moscow City business district. At the same time, the current economic environment and the high cost of capital require flexible transaction structures and sophisticated financial solutions for major investors.

Related materials:

RZD acquired almost the entire Moscow Towers skyscraper for its new headquarters

The government instructed RZD to consider selling Moscow Towers in Moscow City

Advertising on the portal

Advertising on the portal