1. Introduction: The new structure of business Moscow

Moscow's office real estate market is entering a period of transformation. With Moscow City's potential for space growth exhausted, city officials and developers are focusing their efforts on developing the surrounding areas. The "Big City" project is a response to the growing supply shortage in the premium segment and a new driver of business activity in the capital.

2. Moscow-City: a mature market with high demand

Key performance indicators (Q3 2024)

-

Office space: 1.5 million sq. m

-

Vacancy rate: 1.9%

-

Average rental rate: 47 thousand rubles/sq. m/year

-

Rate range: from 29 to 77 thousand rubles/sq. m/year

-

Transaction volume (January–September): 78 thousand sq. m

-

Forecast for the end of 2024: up to 360 thousand sq. m.

Trends

-

The vacancy rate has been steadily declining from 12% in 2020 to 1.9% in 2024.

-

Rental rates are reaching historic highs , growing +12% year-on-year.

-

The average transaction size is 723 sq. m, more than halved compared to 2023.

Significant events

-

Deal of the Year: Russian Railways acquired 263,000 square meters in Moscow Towers .

-

The only project for sale in blocks is iCITY . The average price increased from 270,000 rubles/sq. m (2020) to 704,000 rubles/sq. m (2024).

3. New construction: limitations and potential

Moscow City is nearly out of resources for new construction. Major projects include:

-

iCITY Space Tower (MR Group) — 91 thousand square meters, opening in 2025.

-

One Tower , City Tower, plots 4 and 20 – completion 2026–2030.

-

Total future volume of new facilities: up to 2.1 million square meters (including 1.5 million in operation).

4. Big City: Expansion Strategy

General concept

-

Launched in 2009 as a continuation of Moscow-City.

-

The main development tool is the KRT (complex development of territories) program.

-

Reorganization of industrial zones, transformation into public and business functions.

-

Development of transport, social and engineering infrastructure.

Current and planned indicators

-

Office stock in 2025: 2.85 million sq. m

-

Projected area: ~4 million sq. m

-

Target volume by 2035: up to 6.8 million sq. m

-

Average vacancy rate: 1.5%

-

Average rental rate: RUB 34,100/sq. m/year

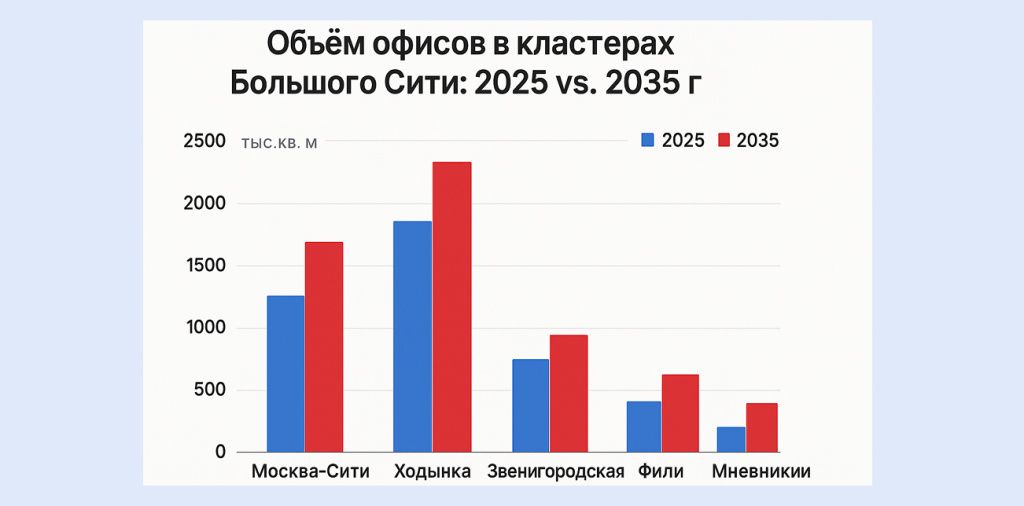

5. Big City Clusters: Comparison and Potential

| Cluster | 2025 (thousand sq. m) | 2035 (thousand sq. m) | Rental rate, thousand rubles | Vacancy rate, % |

|---|---|---|---|---|

| Moscow-City | 1,561 | 2 140 | 51.5 | 1.5% |

| Khodynka | 557 | 2 105 | 37.3 | 2.1% |

| Zvenigorodskaya | 156 | 1,572 | 45.6 | 1.8% |

| Kutuzovsky | 277 | 337 | 37.1 | 0.6% |

| Fili-Mnevniki | 22 | 323 | — | 0.0% |

| Presnya | 260 | 260 | 37.5 | 0.1% |

| October Field | 13 | 18 | 30.0 | 4.3% |

Brief overview

-

Khodynka: the largest increase due to the KRT (the project on 1st Botkinsky Proezd – up to 938 thousand sq. m).

-

Zvenigorodskaya: potential growth of 10 times, active projects - Orbital, JOIS, LIGHT CITY.

-

Fili-Mnevniki: Roscosmos headquarters, covering 200,000 square meters, will be commissioned in 2025.

-

Oktyabrskoye Pole: limited growth, high vacancy rate.

6. Investment attractiveness

Drivers

-

Supply deficit in Moscow City.

-

Infrastructure projects (bridges, roads, metro).

-

Concentration of state corporations, the IT sector, and construction and development businesses.

-

State support and assigned KRT.

Profitability

-

Potential profitability of new properties is up to 11–14% per annum.

-

The most promising clusters are Khodynka and Zvenigorodskaya.

-

Rental rates in new clusters could approach Moscow City levels by 2030.

Risks

-

High dependence on the regulatory environment.

-

Limited number of anchor tenants.

-

Competition between clusters can lead to fluctuations in rates.

7. International comparison

| Location | Rent (in rubles) | Vacancy | Comment |

|---|---|---|---|

| Moscow-City | 47,000 | 1.9% | Cost leader, minimum vacancy |

| Big City (medium) | 34,100 | 1.5% | High potential, active development |

| Belorusskaya (Moscow) | ~30,000 | ~5% | Moderately saturated market |

| La Défense (Paris) | ~66,000 | ~9% | Stable demand |

| Canary Wharf (London) | ~75,000 | ~11% | Post-pandemic recovery |

8. Forecast to 2035

Scenarios

-

Baseline: 4 million square meters of new space, rate stabilization, vacancy rate of 5–6%

-

Optimistic: 6.8–7 million square meters, rate increase to 45,000 rubles, yield up to 14%

-

Conservative: partial implementation of projects, increase in vacancies to 8-10%

Conclusion

The Greater Moscow City is becoming the new core of business activity. Moscow-City will retain its premium segment status, but it is the new clusters that will drive supply growth. If the business climate remains stable, by 2035 Moscow will have a fully-fledged multi-core business structure comparable to leading European cities.

Advertising on the portal

Advertising on the portal