In 2025, the Moscow-City business district demonstrated a qualitative shift in the dynamics of its retail real estate market. By the end of the year, 74 new retail units had opened, while 72 tenants ceased operations. For comparison, in 2024 there were 69 openings and 58 closures.

This indicates not merely continued development, but the formation of a mature competitive environment where the speed of tenant turnover becomes a key indicator of market resilience.

Supply Growth and Local Imbalances

The total retail space in the district reached 59,700 sq m. A significant contribution came from the commissioning of the iCITY business center, which added 8,200 sq m of commercial space.

Amid expanding supply, the vacancy rate increased by 2.1 percentage points to 7.7%. However, the average figure conceals clear polarization:

- In Neva Towers, OKO, Mercury, and Empire, virtually no vacant space remains.

- The highest vacancy rate — 63.2% — was recorded in Tower 2000, primarily due to the reconstruction of the Bagration Bridge and reduced pedestrian traffic.

This confirms that Moscow-City does not function as a single homogeneous market, but rather as a collection of micro-locations with different transport accessibility and foot traffic patterns.

Who Drives Demand

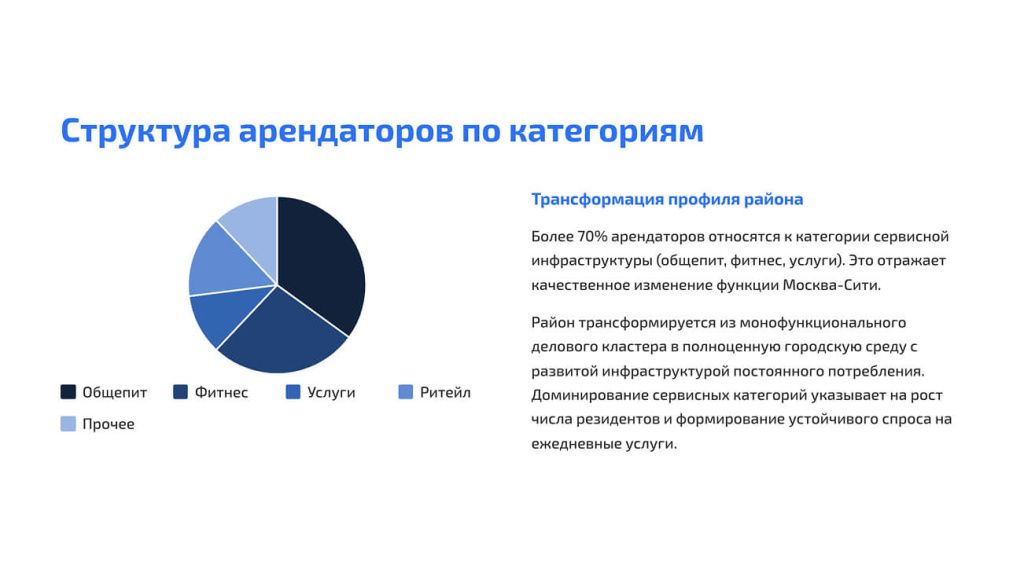

The tenant structure shows a clear shift toward a service- and lifestyle-oriented model:

- Food & beverage — 35%

- Fitness — 27%

- Services — 11%

In fact, more than 70% of retail space is focused on daily consumption by tower residents and office employees. Moscow-City is gradually solidifying its role not only as a business hub, but also as a self-sufficient urban environment with its own leisure infrastructure.

Among notable openings were restaurants on the upper floors of OKO and Empire, as well as a premium car showroom in Neva Towers. The upper levels of skyscrapers are increasingly transforming into gastronomic and representative spaces.

Rental Rates and Format Pressure

Rental rates range from RUB 40,000 to 168,000 per sq m per year. This wide spread reflects differences in traffic, tower status, and unit format.

Accelerating tenant turnover means the market is becoming more demanding: success now depends not simply on financial stability, but on clear positioning and a well-developed customer model.

Outlook: Stabilization Phase and a New Growth Driver

Analysts expect vacancy to decrease to 5–6% in 2026 amid stabilized foot traffic and the launch of new projects, including Moscow Towers.

Given the growth of the residential component and continued expansion of Class A office occupancy, demand is likely to shift toward high-quality service concepts, premium dining, and infrastructure designed for permanent residents.

Advertising on the portal

Advertising on the portal

Any questions or comments?

Реальность такова, что в Neva Towers аренду найти очень сложно, место действительно конкурентное. Мы ждали подходящий объект там почти год, в итоге пришли к выводу, что проще приобрести чем дождаться. На любые площади, очереди стоят. Сейчас в процессе оформления сделки, и хорошо цену зафиксировали сразу, потому что уже +2,5% выросли цены. Даже как инвестиция должно оправдаться

Site administrators response:

Благодарим за содержательный комментарий. Ситуация в Neva Towers действительно подтверждает общий тренд, о котором мы пишем в материале: при ограниченном предложении качественных площадей внутри действующих башен спрос остаётся устойчиво высоким. В таких объектах вакансия минимальна, а ликвидные лоты уходят быстро - как в аренде, так и в продаже. Фиксация цены на раннем этапе в текущей фазе рынка - рациональное решение, особенно с учётом роста стоимости и конкуренции за лучшие площади. В инвестиционной логике подобные активы в Москва-Сити традиционно демонстрируют устойчивость за счёт локации, статуса проекта и сформированной инфраструктуры. Желаем успешного завершения сделки.