Any questions about the City?

Ask us. We know everything about Moscow-City.

Коротко о нас и Москва-Сити

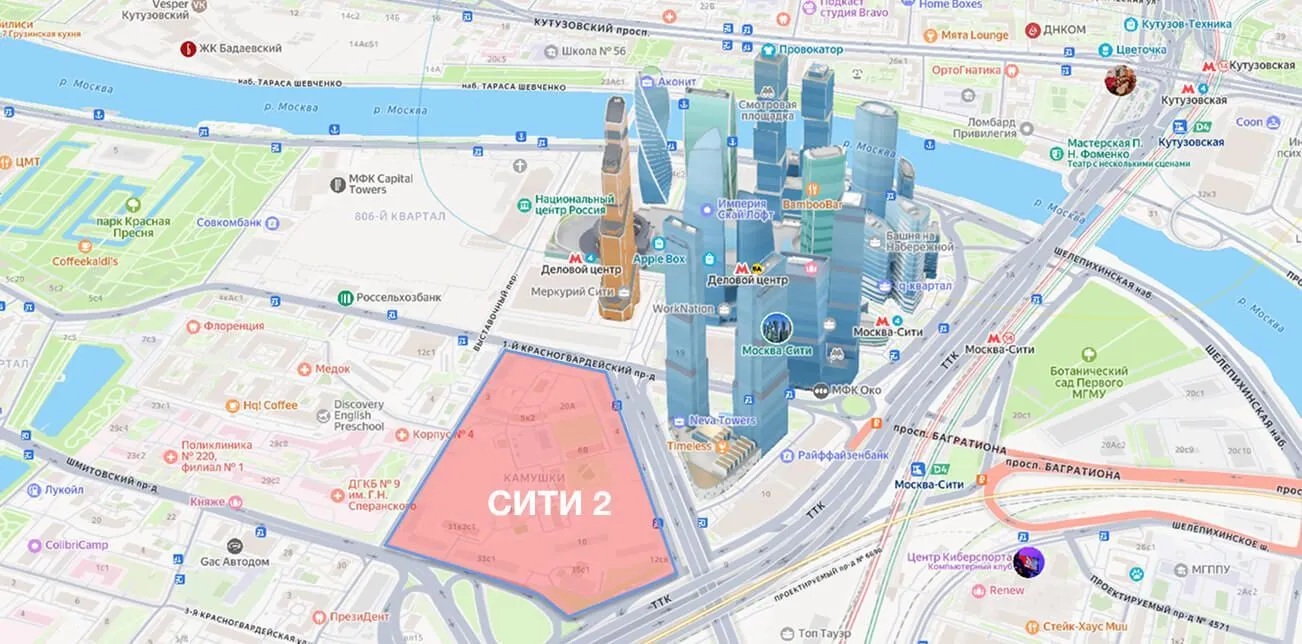

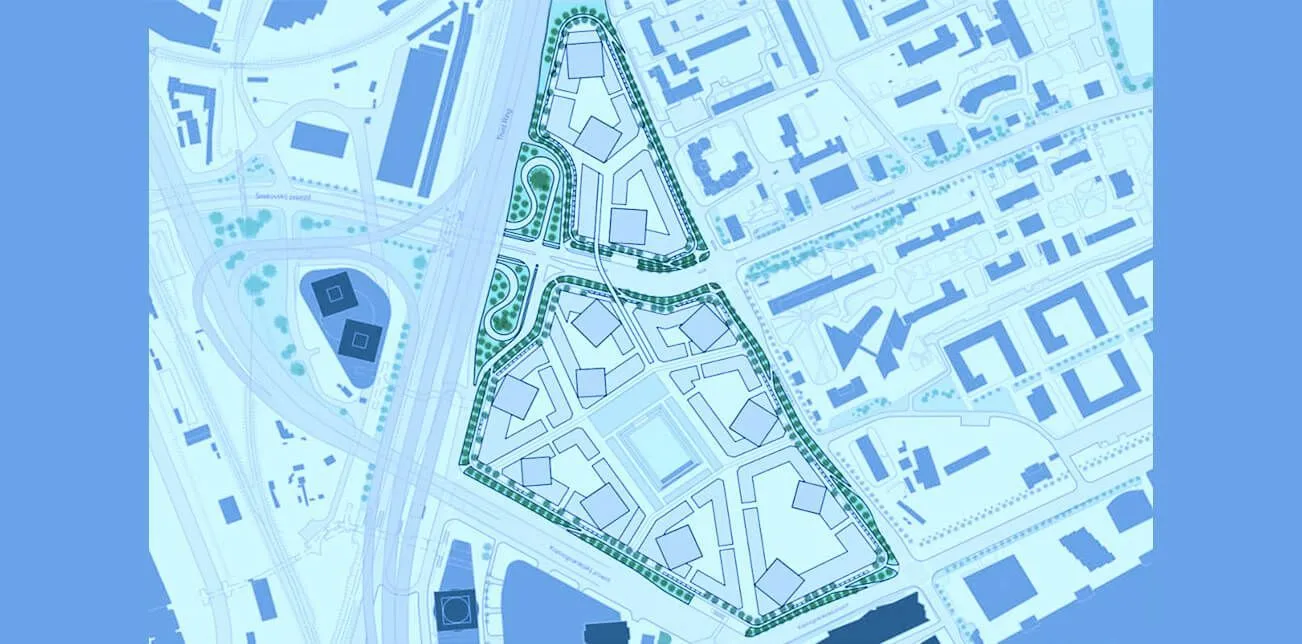

Московский Международный Деловой Центр (ММДЦ) «Москва Сити» — уникальный градостроительный комплекс, где учтены все аспекты будущего делового и культурно-общественного района.

Развитая технологическая инфраструктура, идеальные условия для ведения бизнеса и обустроенные рекреационные пространства — то, что выводит ММДЦ «Москва Сити» в статус новой достопримечательности столицы.

«Москва Сити» — не только про работу: на территории «Москва Сити» есть музей-смотровая, магазины и рестораны, фитнес-клубы, развлечения для детей, городские учреждения. Все, что нужно для жизни и отдыха.

Оставьте заявку

Мы подберем лучшие объекты из базы.

Leave a request

We will select the best objects from the database.

Thank you for your request

Our managers will contact you soon

Any questions about the City?

We will select the best objects from the database.

Thank you for your request

Our managers will contact you soon

Запрос на редактирование

Оставьте запрос на редактирование раздела

Получить доступ

Оставьте запрос на редактирование объекта

Спасибо за обращение

Our managers will contact you shortly

Сообщить об ошибке

Оставьте запрос на исправление ошибки

Advertising on the portal

Advertising on the portal

175

175